This weekend 100 years ago, on April 1 1923, a 'temporary frontier' on imported goods was placed on the boundary line between Northern Ireland and the Irish Free State. This 'temporary frontier' lasted for over 70 years, only rescinded due to the introduction of the Single Market throughout the European Union in 1993.

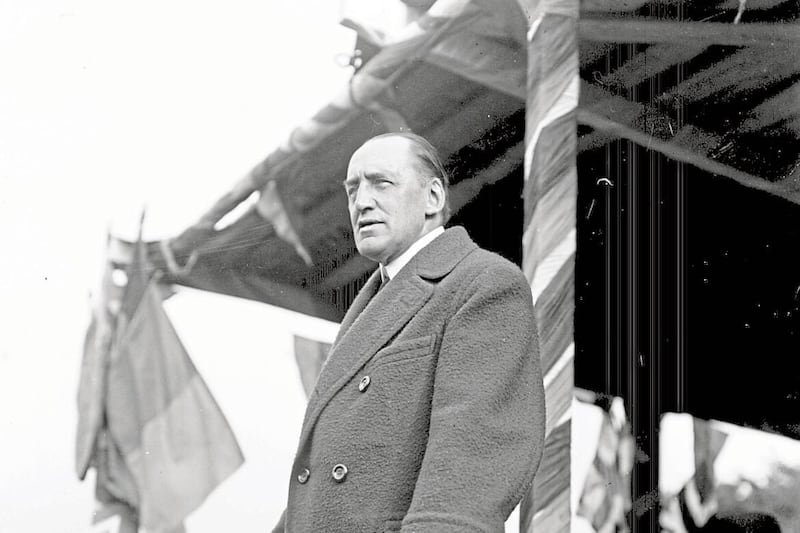

It was the Free State government who introduced the measure that in essence created a hard land border on the island, and not the Northern Ireland government, with its prime minister James Craig claiming: "Those in the south who proposed to erect that barrier wall, and not the north, would be responsible for partition. There was no such thing as partition if they had not a customs barrier between the north and the south."

Why then did the Free State government make such a decision which, on the face of it, seemed one of great folly that would (and ultimately helped to) cement partition?

For years, Irish nationalists considered that self-government without fiscal autonomy was not real autonomy. Few fiscal powers were offered to Ireland under the different home rule schemes introduced from 1886 to 1920. While many in Ireland welcomed the prospect of Ireland managing its own affairs, it was jarring that the fundamental tools needed to do so – control of its financial affairs – would remain in British hands.

The British would retain control of revenue, taxation and customs and excise. Many Irish people complained that in devising fiscal policies, the British catered for Imperial and English interests, not specific Irish ones which were very different.

Most in Ireland long believed there had been no accurate financial figures for Ireland, in part due to the guesswork carried out by the British Treasury who tended to misdeclare Irish numbers. This view was shared by nationalists and unionists.

For example, the British Treasury estimated that Ireland had a surplus of £22,352,900 for the financial year 1920-21 when the real surplus was £15,391,000. It over-estimated Ireland's surplus by almost £7 million, and thus expected Ireland to contribute far more than it was capable of doing.

Under the Government of Ireland Act 1920, which was responsible for the partition of Ireland, Westminster was to retain control of customs duties, excise (with some exceptions) duties, excess profits duties, corporation profits tax and income tax, including super-tax. Of the taxes reserved to Westminster, customs and excise duties comprised the majority of tax revenue intake at the time, with £30 million of the total Irish revenue of £45 million for 1920-21 coming from customs and excise alone.

There was to be no divergence in customs policies nor customs barriers between both Irish jurisdictions and Britain, as the British government claimed customs barriers would lead to increased division and prevent the eventual unity of Ireland, which it proclaimed was its ultimate goal.

Under the Act, a Joint Exchequer Board was established to determine what part of the proceeds of the reserved taxes was attributable to each Irish jurisdiction. The Board was to comprise of five members; two appointed by the British Treasury, one by the Treasury of Southern Ireland, one by the Treasury of Northern Ireland and the chairperson appointed by King George V.

As a reflection of the Act as a whole, the limited financial measures offered to both Irish jurisdictions being overseen by a body almost completely controlled by the British was never going to come close to meeting the minimum demands of Irish nationalists, particularly of Sinn Féin who sought as much independence from Britain as possible, including full fiscal autonomy.

While Northern Ireland came into being and was stuck with the financial provisions of the Government of Ireland Act 1920, the Act did not become operational in the 26 counties which instead formed the Irish Free State following the signing of the Anglo-Irish Treaty in December 1921.

The nascent Irish Free State was able to diverge from the fiscal policy of Britain due to a late concession offered by British prime minister David Lloyd George to the Sinn Féin plenipotentiaries in the Treaty negotiations, when he suddenly and surprisingly abandoned free trade as the negotiations reached their conclusion on the night of December 5 1921, promising to "agree provisionally that there should be freedom on both sides to impose tariffs either liked".

The offer of fiscal autonomy for the Free State came out of the blue but was especially welcome to Arthur Griffith, who had long coveted a separate fiscal policy to Britain. Michael Collins subsequently claimed: "We held out for fiscal freedom to the last... It was the last concession that Mr Lloyd George made, and that was after midnight on December 6, when we thought all had failed, and war had to begin again. When he gave in on that, Mr. Griffith and I were prepared to sign. It is the most valuable part of the Treaty."

The provisional government of the Irish Free State was unable to assert its fiscal independence for some time. On the brink of civil war, it asked the British government to act as agents of its revenue for the financial year 1922/1923, before it pursued its own fiscal policies. It then created the new department of Revenue Commissioners and sought help from the British to train its staff and to provide templates and manuals on how best to run its revenue department.

As a key symbol of independence, the Irish Free State was determined to diverge from the British fiscal space at the earliest opportunity. The dilemma for the Free State government was that attaining fiscal autonomy required the need for the erection of a 'customs ring' around its borders, by sea and crucially by land.

The government accepted that the creation of a land frontier "may be regarded as stereotyping the present boundary line between the Free State and Northern Ireland and might, to that extent, prejudice our decision before the Boundary Commission".

However, with there being little prospect of the Boundary Commission convening shortly afterwards (and, with it, the potential to reduce the border), the Free State felt it needed to pursue its own fiscal policies at the earliest possible opportunity.

As it transpired the Boundary Commission did not meet until late 1924. Despite the implications such a decision could have on the border between the Free State and Northern Ireland, the Free State government felt it had no choice, if Northern Ireland opted out of an Irish customs union, but to erect customs barriers along the 300-mile-long land frontier from Carlingford Lough to Lough Foyle. There could be no fiscal autonomy without customs barriers on the land border and if that was the case the British would still be dictating financial policy.

Presented with a choice of remaining within the UK fiscal system or joining an all-Ireland one, unsurprisingly, Ulster unionists emphatically chose the former.

Hugh Pollock, the Northern Ireland Minister for Finance, stated: "If we must have some such [customs] barrier we would rather it would be with the south with its 4,000,000 people than England with its 40,000,000."

The Northern Ireland government wanted the Irish Free State to retain a customs union with the UK, something the Irish Free State would not contemplate given how hard it had fought to achieve fiscal autonomy.

On top of seeking fiscal independence from Britain and to generate revenue for the exchequer, the policy was also an attempt to apply economic pressure on the nascent northern jurisdiction. The Free State-sponsored North-Eastern Boundary Bureau claimed the erection of a customs barrier would "gravely imperil" the "future prosperity" of Northern Ireland and would "extinguish the enormous distributing trade Belfast does with the rest of Ireland".

Like the naïve and destructive Belfast Boycott policy before it, many in the Free State believed the economic pressure caused by customs barriers would force the north to end partition. At the time, pro- and anti-Treatyites supported a land border as a sign of nationality and to force Northern Ireland into union through loss of trade.

Conversely, Ulster unionists were opposed to the land border then. Notably, in many ways, roles have been reversed 100 years on, with nationalists seeking no return to a land border while many unionists now prefer a land border to the Irish Sea border imposed under the Northern Ireland Protocol and Windsor Framework.

It is striking how short-sighted and dogmatic most strains of nationalism were at the time on how best to achieve Irish unity, not realising the harm customs barriers were causing in achieving this professed goal.

It is similar to many of the claims made now against the DUP, that its policies from its initial support of Brexit onwards have hampered Northern Ireland's position within the UK instead of strengthening it.

Achieving financial independence from Britain, as all other dominions such as Canada and Australia at the time had, was clearly a huge objective for Sinn Féin and without it, the independence gained by the Free State would have been very limited.

However, there were consequences in demonstrating this newly acquired financial freedoms. Customs barriers and checks had to be erected to protect the 26 counties' fiscal space, including along a land frontier the government opposed and one that had not even come close to being settled.

This was another example of the Free State's rhetoric desiring Irish unity clashing with its actual policies which reinforced partition.

Cormac Moore is author of Birth of the Border: The Impact of Partition in Ireland (Merrion Press, 2019).