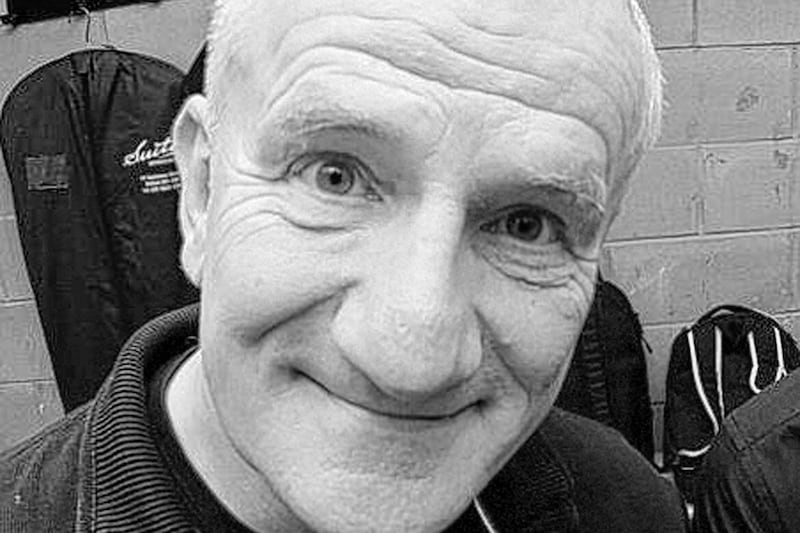

CALL me superstitious but I worry when I hear Jeffrey Donaldson confidently announce there won't be a united Ireland in his lifetime. Surely he's tempting fate as thankfully, none of us know our departure date.

Not that such hubris is confined to unionist politicians, with taoiseach Leo Varadkar recently saying there will be a united Ireland before his demise.

Who'll be proved right will be something I'll be watching intently; indeed, if it weren't uncouth, I'd be tempted to take a punt on the outcome.

Read more:

- Jake O'Kane: When the fanatics stop fighting, the talking must start for peace between Israel and Palestine

- Jake O'Kane: Is there another place on earth with so many agreements but without any actual agreement?

- Jake O'Kane: The Ireland of cead mile failte is a myth – we need to make it a reality

Just imagine Jeffrey's embarrassment if he finds himself still sucking air as a tricolour is raised atop Stormont. I wonder if his sense of scunderment would force him into committing harakiri? And will Leo go all the way and have himself cryogenically frozen just to ensure he's proved right?

While who wins between the two on the timeframe for reunification is unknowable, what we do know is that Leo and the Republic have won the economic battle hands down.

I'm old enough to remember family trips south on a Sunday so my father could avail of their cheaper alcohol. Having been waved past a solitary customs guard in a hut on the road to Omeath, it felt like we were travelling back in time as the road became a bumpy track and the houses antiquated.

How things have changed, with the Republic's coffers bursting at the seams with an expected budget surplus of €65 billion between now and 2026. They've so much spare cash they're siphoning some off into a sovereign wealth fund to be known as the 'Future Ireland Fund', estimated to be worth £86bn by the middle of the 2030s.

In the shorter-term they announced in their recent budget that the minimum wage will increase to €12.70 an hour, a tax break for small landlords, a €450 winter credit payment and a one-year mortgage interest tax relief for some homeowners.

The newfound wealth is due to having set a 12.5% corporation tax rate, leading to many of the biggest US multinationals basing themselves in Dublin. The days of milk and honey are coming to an end as they've agreed to support a deal put forward by the Organisation for Economic Co-operation and Development to set a global minimum corporation tax rate of 15%.

The Republic's abundance stands in stark contrast to our financial predicament as we face into a £700m budget deficit leading to cuts in infrastructure, education, social welfare and health.

Our English overlord, Chris Heaton-Harris, seems content to allow the lights to go out – both figuratively and literally with street lighting possibly turned off within weeks – in his attempt to pressurise the DUP back into Stormont; the real victims, as always, will be the poorest within our society.

Read more:

- Has the Northern Ireland protocol undermined the union? Alex Kane and Brian Feeney debate

- Review: Liam Neeson drives angry in explosive new thriller Retribution

- Stormont return needed to see full benefit of investment trip – Farry

Not that we're alone in our economic difficulties as the Joseph Rowntree Foundation reported a doubling of the number of people in the UK facing destitution over the last five years, with over two-thirds being disabled or having health issues.

This report was published just weeks ahead of an end of the cap on bankers' bonuses, the only policy remaining from the disastrous mini budget of Kwasi Kwarteng which led to both his and Liz Truss's removal from office and a spike in interest rates and mortgage payments.

Kwarteng had argued that the cap was a hindrance to recruitment into the City of London, conveniently ignoring the fact that obscene banking bonus schemes in the past were judged to have been a major contributing factor in the banking sector's high stakes risk-taking which precipitated the global financial crisis of 2007-2008.

Back then, it was argued the banks were 'too big to fail', leading to trillions of dollars of public money being handed over in bail-outs, proving that banks can't go bankrupt. Virtually none of those responsible for the disaster were ever held accountable for their greed and incompetence.

I remember being taught in school about the boom-and-bust nature of capitalism but at that time, the gaps between the two could be measured in decades. This timeframe has shrunk dramatically; this latest move to remove the cap on bankers' bonuses proves nothing has been learned from the excesses of the past as we face into yet another round of unchecked gambling by the investment banking sector.

I feel sorry for the gamblers I watched during my recent trip to Las Vegas as they've yet to discover there is one guaranteed way to gamble yet never lose: it's called banking.