The average five-year fixed-rate homeowner mortgage has jumped above 6% for the first time since November last year, new data shows.

Across all deposit sizes, the typical rate on the market on Tuesday was 6.01%, up from an average rate of 5.97% on Monday, according to financial information website Moneyfacts.

The total number of residential mortgage products available shrunk to 4,404, from 4,396 the previous day.

The last time the typical five-year fixed-rate residential mortgage topped 6% was in November last year, when rates rose sharply following former chancellor Kwasi Kwarteng’s mini-budget.

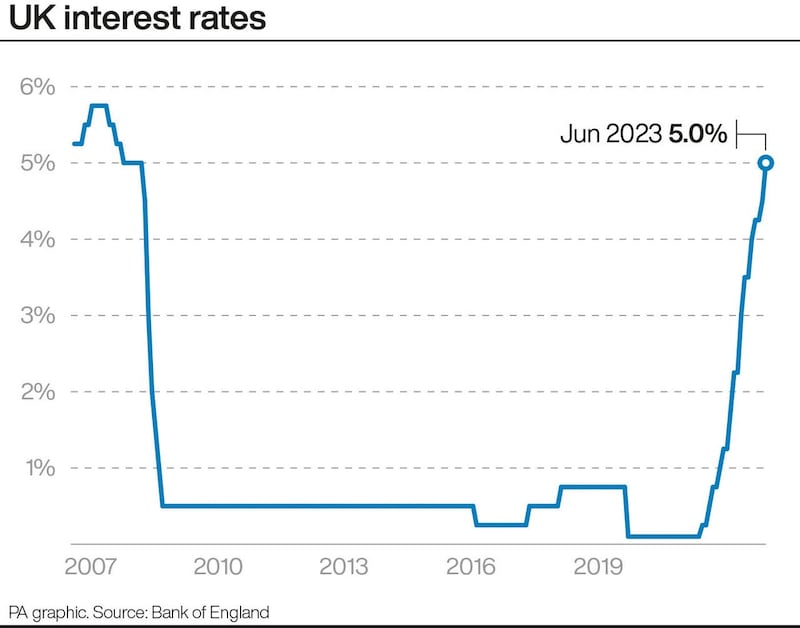

It comes as the Bank of England pushed the UK base interest rate to 5% last month, opting for a bigger hike than most economists were expecting.

It marked the 13th time in a row that the central bank has pushed up rates, in efforts to quell rampant inflation across the UK.

Lib Dem MP and Treasury spokeswoman Sarah Olney urged the Government to do more in response to climbing mortgage rates.

She said: “This is yet more mortgage misery for homeowners on the brink.

“Rishi Sunak asking homeowners to hold their nerve is sounding more tin-eared by the day.

“It shows this Conservative Government is just totally out of touch.

“Conservative ministers sent mortgages spiralling through all their chaos and incompetence, now they are refusing to lift a finger to help.”