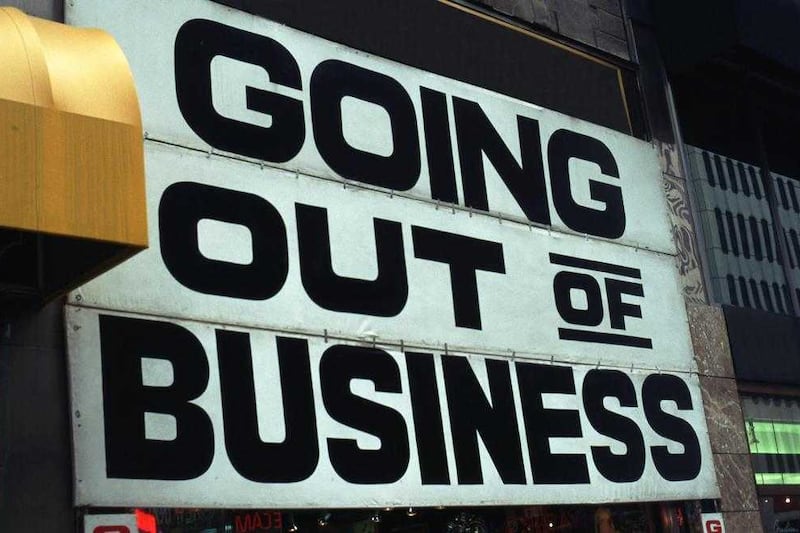

More than 200 businesses collapsed in Northern Ireland during 2023, figures from the Insolvency Service are expected to show next week.

That total is generally on a par with 2022, and comes as the removal of government support measures, compounded by increased interest rates, inflation-eroded margins and weak demand, pushes more firms to the brink.

In November alone, there were 26 company insolvencies registered in Northern Ireland, which was 30% higher than the same month a year earlier.

This was comprised of six Creditors’ Voluntary Liquidation (CVLs), which is a formal liquidation process which brings about the end of an insolvent company, 13 compulsory liquidations, five administrations and two Company Voluntary Arrangements (CVAs), where creditors are paid over a fixed period.

In total, 190 companies went over a cliff in the first 11 months of last year.

And when the December figures are released on January 16, it is likely to take the overall number to more than 200 (in 2022, the total number of business failures in Northern Ireland stood at 214).

In recent months, companies have been affected by multiple economic issues, including cautious consumer spending and rising costs.

And alongside these, requests for wage increases and higher energy bills are also hitting businesses hard.

Meanwhile there were 111 individual insolvencies in the north in November, bringing the total for the year so far to 1,126 - which is already more than the whole of 2022, when 1,062 people got into financial trouble.

The most common formal debt solution has been an Individual Voluntary Arrangements (IVA), where individuals are asked to make a single monthly payment for a set period of time, typically between five and six years.

With an IVA, people do not necessarily need to pay off the full amount they owe, as any debt remaining after the term reaches its end will be written off (unlike a debt management plan, which requires payments to be made until the debt is cleared in full).

This week’s Stubbs Gazette, established in 1828 and which provides business information and credit data related to companies and consumers, lists 69 people in the north under its most recently IVAs section, with most having come before the courts in December.

They come from across every county in the north and range in age from a 22-year-old in Cookstown to a 75-year-old in Castledawson.