THE north’s commercial property sector has recorded the busiest quarter since the outbreak of Covid-19, according to a new report.

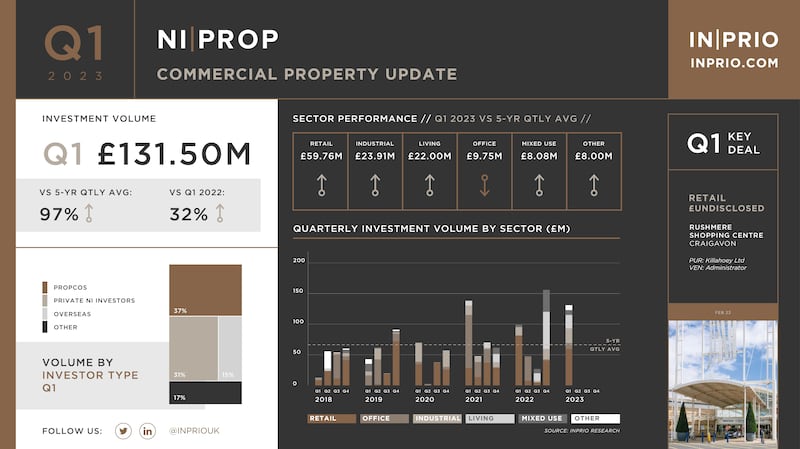

Property investment consultancy INPRIO said £131.5 million changed hands in the sector during the first quarter of 2023, 97 per cent above the quarterly average of the past five years.

The value of the deals in the first quarter (Q1) of 2023 was the second highest opening three-months for the north's commercial property sector in the past decade.

The 19 deals tracked by INPRIO’s Q1 insights report also made it the busiest quarter in terms of transactions since Q4 2018.

But the consultancy firm warned the market has already slowed significantly in the second quarter of the year.

INPRIO's analysis of the market in Q1 2023 noted a rise in the number of ‘off market’ deals in the north.

“While not typically a characteristic of the Northern Irish market, off-market transactions are becoming more common with four substantive deals recorded this quarter,” states the report.

The most notable example in the first quarter was an off-market disposal of a Marks and Spencer investment located at its flagship Belfast store on Donegall Place to a local private investor for an undisclosed price.

The biggest Q1 commercial property deal was the sale of Rushmere Shopping Centre out of administration to Killahoey Limited, a joint venture between Sheephaven and May Street Capital, for an undisclosed price.

Target Healthcare REIT’s sale of four care homes in the north for £22m was the second biggest deal done in Q1 2023, according to INPRIO’s analysis.

Notable in the report was the activity of local investors in early 2023.

Some 15 of the 19 Q1 properties were bought by local private investors, totalling almost £41m.

But INPRIO has warned that the market is expected to significantly slow in the second quarter of 2023.

“With less than £35m of deals already agreed or in legals, combined with a significant slowdown in the supply chain, the outlook for Q2 is in stark contrast to Q1. However, the keen investor appetite remains should new stock emerge.”

INPRIO also noted that the office market “remains in flux”, as it continues to adapt to the impact of the pandemic.