THE average house price in Northern Ireland increased 3.1% to £179,530 between the second and third quarters of 2023 amid a slump in new build properties coming on the market.

The latest official house price index from the Northern Ireland Statistics and Research Agency suggests the price of the average residential property was 2.1% higher in the third quarter (Q3) of this year compared to the same quarter 12 months earlier.

It means the price of the average home in the north as increased by around £40,000 since the start of the Covid-19 pandemic.

House prices in Northern Ireland fell at the end of 2022 and at the start of 2023, but have been climbing since then.

It’s thought the price increase reflects the competition for the north’s dwindling housing stock amid a slowdown in house building and developers passing on the soaring costs of materials.

Construction has been one of the sectors worst hit by inflation over the past year.

Ulster Bank’s chief economist, Richard Ramsey, said the number of new starts in Q3 2023 was the lowest Q3 figure since 2013.

He said the number of new houses started in the first nine months of this year was 21.7% down on the same period last year and 25.5% below the same period in 2019.

A total of 3,889 dwellings were completed in the past three quarters, which was 22.5% down on last year and 1,573 (29%) down on 2019.

The sharpest quarterly increase was in terrace housing, where prices rose 4.5% between Q2 and Q3 to £124,875, which was 1.9% up on Q3 2023.

The average detached house increased by 1.6% over the quarter and 1.9% over the year to £275,312, while semi-detached prices were up 3.1% in Q3 to £172,643, an annual increase of 1.8%.

At £135,147, the average apartment price rose 3% over the quarter and 4.4% over the year.

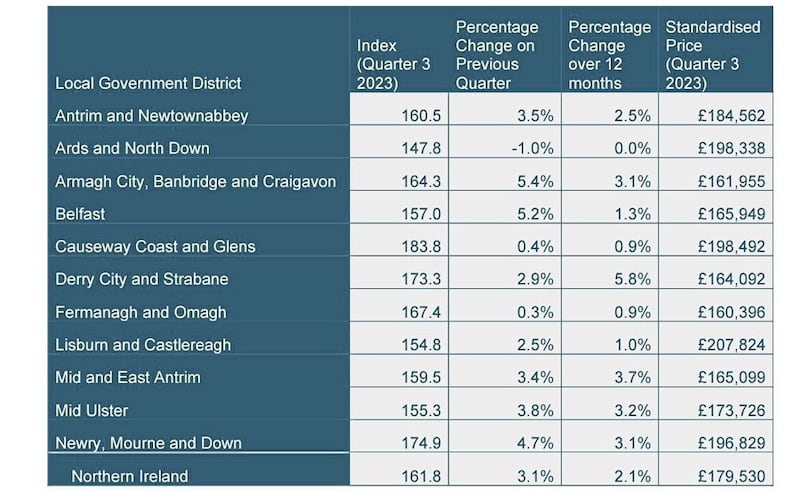

The range between the north’s most expensive and most affordable areas to buy was just over £47,000 in the third quarter, according to Nisra’s index.

Despite prices increasing by 0.9% over the quarter, Fermanagh and Omagh came in bottom of the house price table, with an average of £160,396, just below Armagh City, Banbridge and Craigavon (£161,955).

Derry & Strabane saw the sharpest quarterly increase anywhere in the north, with prices increasing by 5.8% to £164,092 between Q2 and Q3,

Lisburn and Castlereagh was again the most expensive place to buy a home last quarter, with prices rising 1% over the quarter and 2.5% over the year to £207,824.

Significantly, the continued increase in the price of housing on the north coast saw Casuseway Coast & Glens over take Ards and North Down as the second most expensive area to buy in the north.

The average home on the Causeway Coast increased 0.9% to £198,492 in Q3, ahead of Ards and North Down, where prices were recorded as 1% lower than 12 months earlier at £198,338.

Nisra’s index also showed prices continuing to soar in Newry, Mourne in Down, rising 3.1% over the quarter to £196,829, which was 4.7% up year-on-year.

The price of the average dwelling in Belfast (165,949) was 5.2% higher than Q3 2022, following a 1.3% increase over the last quarter.

The continued rise in Northern Ireland housing bucked the wider UK trend, where the price of the average residential property fell 0.1% to £291,000.

Nisra said 5,524 residential properties were sold in the third quarter of 2023, but that figure is expected to be revised upwards, due to late returns on new properties being entered on the NI valuation list.