THE Abbey Retail Park in Co Antrim has been sold to a Californian investment trust for around £40 million.

The Realty Income Corporation has bought the retail asset just three years after Toronto’s Slate Asset Management acquired it for £33m.

Details of the purchase have been disclosed in a new commercial property report published on Tuesday by Lambert Smith Hampton (LSH).

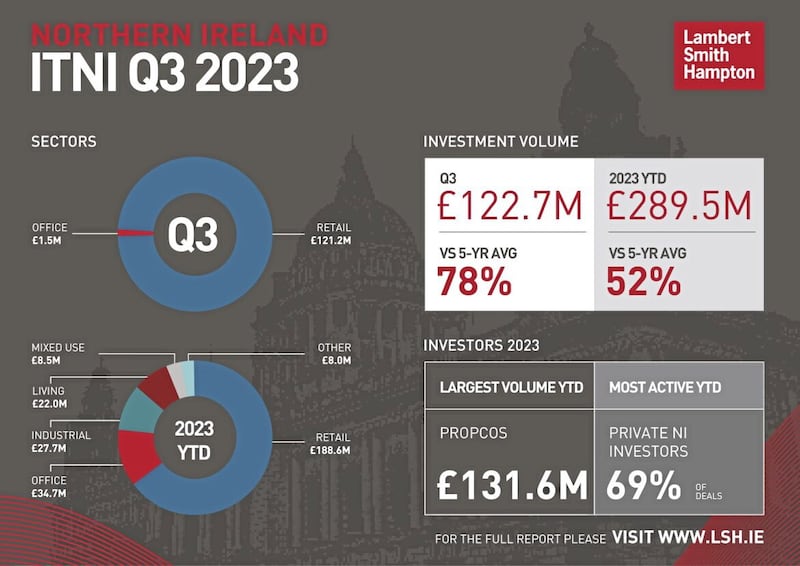

The Investment Transactions Northern Ireland (ITNI) report revealed commercial property activity in the north during the third quarter (Q3) was dominated by retail deals.

While the number of transactions were below the longer-term average, LSH said in volume terms, the sale of Forestside, Foyleside and Abbey Retail Park, made Q3 2023 the biggest quarter for retail transactions since Q3 2017.

Forestside shopping centre was sold last month to Michael and Lesley Herbert for £42m, while a group of local investors, led by Patrick and Edmund Simpson, bought Foyleside in Derry for £27m.

Read more:

- What do the new owners of Belfast's Forestside have in store?

- Foyleside shopping centre sold to local business consortium for £27m

- One of Belfast's most expensive student schemes sold as part of £300m deal

Both retail centres were put on the market by Kildare Partners.

The same report revealed the virtual collapse of the office market in the north in 2023.

LSH said investment volume in the office sector was recorded at £1.5m for Q3 2023, 91% below the five-year quarterly average.

The only office deal of note during the quarter was the purchase of 16 Wellington Park for £1m by a local investor.

No transactions were reported in the industrial sector, although LSH said six properties are currently agreed and expected to complete before the end of the year.

In total, total commercial property investment volume in the first three quarters stood at £289.5m, 52% above the five-year Q1-Q3 average and 66% above the same period in 2022.

The figure does not include the Vita Group’s £300m deal to sell three student accommodation schemes, including the recently constructed development on Belfast’s Bruce Street.

No breakdown has been provided for the value of the 269-unit scheme in Belfast.

LSH director, Jonathan Martin said local investors are the mainstay of the northern investment market.

“The economic landscape has led to a shift in investor trends, with local investors now not only the most active, but also accounting for the largest proportion of investment volume.

“Rebased retail rents and attractive double-digit yields have brought shopping centres back into focus for investors.

“The final quarter of 2023 is expected to be subdued, when compared with Q3, and we are tracking approximately £20m of deals either agreed or in legals.

“Investors remain keen to deploy capital and the stabilisation of interest rates will undoubtedly increase investor confidence as we move into the final quarter.”

Claire Shaw, senior research analyst at Lambert Smith Hampton, added: “While annual volume for 2023 will be ahead of trend, new supply to the market has slowed to a trickle.

“On the upside, the sale of the recently completed purpose-built student accommodation scheme on Bruce Street demonstrates that investor appetite remains buoyant for prime assets within the living sector.

“And while economic headwinds continue to create challenges, the easing of inflationary pressures and the likely stabilising of interest rates should increase confidence in potential vendors who may capitalise on the current supply issues.”

Correction: This article has been corrected from an earlier version which reported Abbey Centre had been acquired by The Realty Income Corporation.