THE north’s economy will contract in 2023 before returning to growth in 2024, according to a new outlook published by the Ulster University Economic Policy Centre (UUEPC).

Rising inflation, driven by high energy prices and the subsequent response by the Bank of England to increase interest rates, will produce a recession next year, the forecast states.

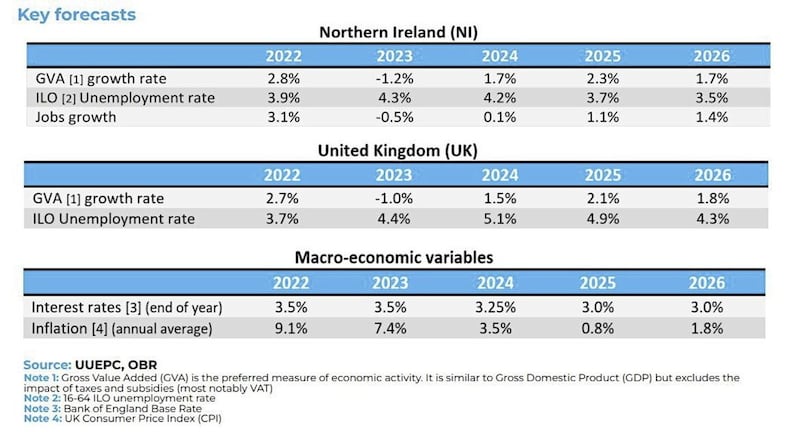

The UUEPC report anticipates that GVA (growth value added) in Northern Ireland will decrease by 1.2 per cent next year before rising by 1.7 per cent in 2024 and 2.3 per cent in 2025.

GVA is similar to GDP, but excludes the impact of taxes and subsidies.

Notably, the forecast predicts the contraction in the north during 2023 will be worse than the UK as a whole, but the EPC expects GVA to grow at a faster here in 2024.

The director of Ulster University’s EPC, Gareth Hetherington said the sharp rise in energy costs as the economy bounced back from the pandemic, had created “a new economic shock”.

But he said the state of public finances in 2023 means the UK Government will not respond on the scale witnessed during the Coronavirus lockdowns.

He said the north’s most energy intensive sectors, such as transport, hospitality, manufacturing, utilities and agriculture will be hardest hit in 2023.

After a period of near record lows for unemployment, the university’s economists expect the recession will hit jobs growth next year, with the unemployment rate rising to 4.3 per cent.

The report states that unemployment will remain above 4 per cent until 2025, when it predicts jobs growth will return.

The latest official measure of the economy, the Northern Ireland Composite Economic Index (NICEI), revealed an economic contraction here during the second quarter of 2022.

If the next report (due to be published in January) reveals another contraction, it will mean the north will be in a technical recession.

Gareth Hetherington said while the bank of England’s move to hike interest rates to 3 per cent in November is unlikely to be the last increase in the current cycle, he said the market had now significantly revised down previous forecasts of the peak rate, and rates may now be close to peaking.

However he said it will still bring pain for many households.

“This will be the first experience many people will have had of significantly higher interest rates as they look to secure their first mortgage or roll-over their existing mortgage deals and each Monetary Policy Committee meeting now brings the prospect of higher debt repayment costs when for years they past with little or no change,” said Mr Hetherington.