CAR dealerships in the north have sold 10,000 fewer new motors in 2022 compared with pre-Covid levels, new figures show.

The local industry suffered its second weakest May in 30 years, with just 3,328 new cars registered, the Society of Motor Manufacturers and Traders (SMMT) said.

It represented a 14.2 per cent drop, or 551 vehicles, on the same month last year when 3,879 new cars were sold.

Only May 2020 was worse for the industry, when car dealerships managed just 144 sales under the tightest of Covid-19 restrictions.

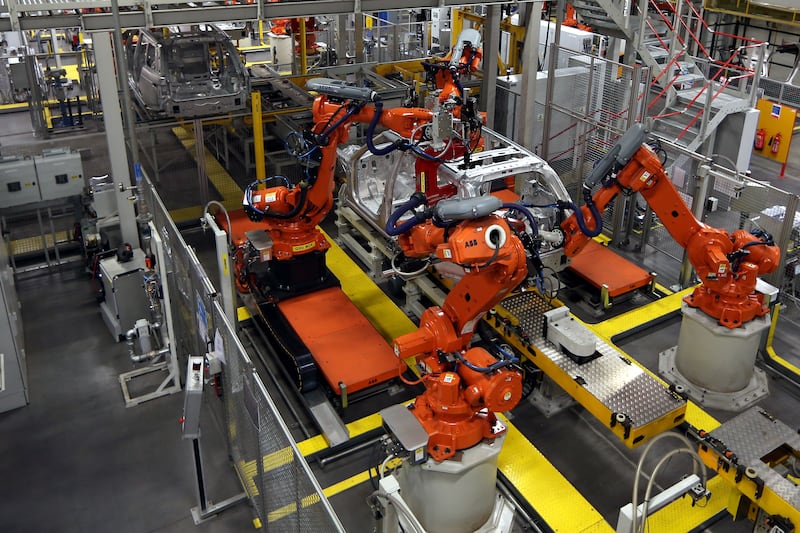

The SMMT attributed the decline to shortages of components which are reducing vehicle availability "despite demand".

The latest data shows 17,600 new cars registered in Northern Ireland during the first five months of 2022, the third worst start to the year on record.

Sales of new cars this year to date are 31 per cent down on 2019, equivalent to 8,067 fewer new cars.

But when compared to the pre-covid long-term average, the gap is closer to 10,000.

Although 2022 sales are still 4.9 per cent up on 2021, the gap is narrowing as each month passes. If the current trend continues, 2022 will be the second worst month on record for the industry since 1992.

Ulster Bank’s chief economist Richard Ramsey, said like the rest of the UK, Northern Ireland’s new car sales “remained stuck in reverse gear in May”.

“Supply chain disruption within the automotive industry continues to hamper car production, with the ongoing war in Ukraine exacerbating the situation,” he said.

Registrations of pure electric cars UK-wide bucked the overall trend last month according to the SMMT, with a 17.7 per cent year-on-year increase.

Electrified vehicles such as pure electrics, plug-in hybrids and hybrids accounted for three out of 10 new cars in May.

But Mr Ramsey said motorists planning to escape the record petrol and diesel prices with a move to an electric vehicle will discover that the delivery time for some of the most popular brands and models is in the region of 18 months.

“The choice is to extend the life of their existing car or pay an inflated price for a second-hand vehicle,” said the economist.

“With supply chain disruption well into its third year expectations for a meaningful pick-up in car production have been pushed well into 2023.”

He said holidaymakers hiring cars this summer will also notice a significant increase in the cost due to the shortage of new and used vehicles.

“With the cost-of-living crisis intensifying, those consumer sensitive sectors battling a consumer recession will be hoping that those households unable to splash out on a new car will instead spend more on retail and hospitality,” said Mr Ramsey.

“That is one silver lining on the oncoming storm clouds. After the financial crisis and subsequent cost-of-living crisis motorists downsized their ambitions for smaller, more energy efficient vehicles.

“History will repeat itself with the current cost-of-living crisis but a key difference this time around is the price of used cars has surged.

“Bagging a small fuel efficient bargain is easier said than done. Some motorists may ditch the idea of owning a car altogether.”