LET go of certainty. The opposite isn’t uncertainty. It’s openness curiosity and willingness to embrace paradox, rather than choose upsides. The ultimate challenge is to accept ourselves exactly as we are, but never stop trying to learn and grow.

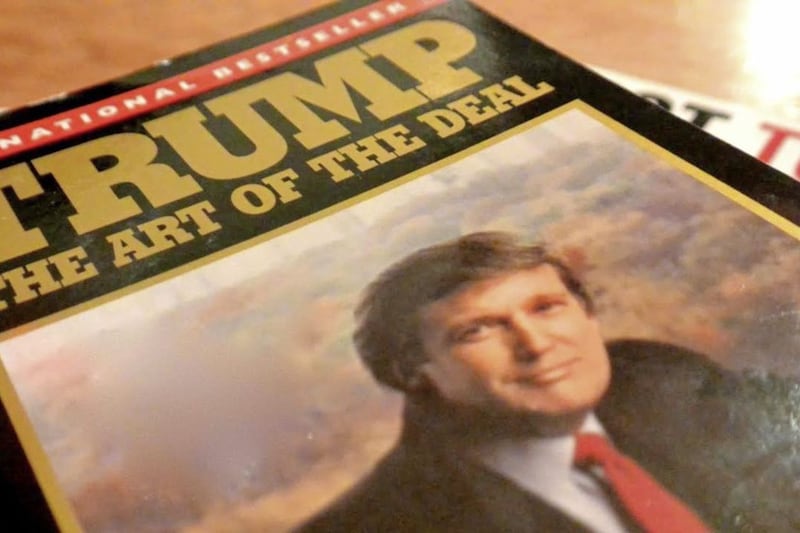

Those are the views of Tony Schwartz, the American journalist, business book author, professional speaker, and the ghost-writer and credited co-author of 'Trump: The Art of the Deal'.

It would be fair to suggest that we are now in the midst of a period of significant global uncertainty given the huge political tremors that have occurred in the last 12 months.

Closer to home and on the island of Ireland there is a very interesting situation developing with regards to how two jurisdictions on the one island decide to work together in the next few years given the ramifications that will be associated with Brexit.

In Northern Ireland things have got a little more complicated given the fact that Stormont is closed for the immediate future with an election pending. When the doors will open again and a board of directors appointed to govern, the country is really anyone’s guess.

I read with interest last week the commercial property market overview of the performance of the Republic of Ireland’s property market in the last few years. It’s been an incredible turnaround with property transactions well into the tens of billions of euros and commercial property agents busier and more active now, than in the years of the Celtic Tiger.

The health note here in my view, though, is that the majority of the transactions in the last few years have been fuelled by American private equity - ie other people's money. The challenge being the only way the funds will be able to exit is whenever the Irish banks are fit enough to get back in the market.

In Dublin last year alone the agents transacted over 2.5million sq ft of office deals with a total of 264 transactions. To put this into context Belfast transacted in the region of 450,000 sq ft with a quarter of that figure comprising one deal.

So what now? Well, I have been taking the temperature of the local property market in the last few months and spoke to many of the stakeholders. The good news is that a number of the developers, visionaries and entrepreneurial investors are back in play and keen to get their buildings out of the ground.

But the challenge they have is threefold - access to development finance, planning law, and the dearth of pre-lets that take place in our market.

Development finance is a tough nut to crack,but if you have the right project, team and can put an outstanding building up, your chances of getting that golden ticket in the form of a pre-let is still possible, given the absolute lack of supply. Planning is also still an issue in Belfast and my own view is that we need a complete overhaul in terms of the tall buildings policy that operates in the city.

In the immediate future we need Northern Ireland plc back in play and the politicians back to work to deliver a programme for government.

So maybe Schwartz was right and we all should actually let go of certainty and grasp the nettle. Lick our wombs, swallow our pride and get on with the job in hand . . .

:: Conor Devine (conor@gdpni.com) is principal of GDP Partnership (@EquityExpertsNI) which specialises in mediating with banks. Follow him on Twitter at @Conor_devine