LEGISLATION due to be implemented in the Republic within days could end the practice of 'bankruptcy tourism' which has seen hundreds of credit crunch debtors crossing the border to go bust in Northern Ireland.

The Irish Cabinet has agreed to reducing bankruptcy terms from three years to just one year, and it is hoped a formal bill will be enacted by the end of this year.

And that should close the loophole where distressed Irish moguls - ranging from a boy band star and former government minister - have turned to the UK to declare bankruptcy under less punitive terms.

"The less onerous duration in the UK spawned the ‘bankruptcy tourism’ term, but the days of Northern Ireland operating as a haven for bankruptcy look to be numbered," according to James Neill, managing director of insolvency practitioners HNH Group.

At the start of the recession, going bust in the south meant a 12-year purgatory, but this came down to three years for a discharge and now bankrupts could potentially be clear in just 12 months.

Mr Neill added: “This move is particularly pertinent when you consider the current stage of the recovering economies, both north and south of the border.

"It is a clear catalyst for recovery in the Republic, implementing legislative change in an attempt to move forward from the deep and cutting recession of the past seven years.

“The law change will naturally give rise to an increase in pressure on relevant government authorities, with the Irish government cognisant of an impending influx of bankruptcy cases, should the legislation come into force.”

The south's Department of Finance has moved to abolish the statutory hearings that take place subsequent to an individual being adjudicated bankrupt. It is hoped this will slash the number of bankruptcy hearings and alleviate pressure on the court system.

"This has a particular asymmetry to the expected impact of the news in Northern Ireland, where in recent years the court system has been inundated with bankruptcy hearings and petitions," Mr Neill says.

"Some of these have been Irish nationals who have circumvented Irish bankruptcy laws and utilised UK legislation, so it is hoped this legislative change will have a direct effect in reducing pressure on the Northern Irish court system.

Previously, all Irish bankruptcy applicants had to do was prove that their "centre of main economic interest" - effectively the home of their business - was in the UK and they could be declared bankrupt and then discharged a year later.

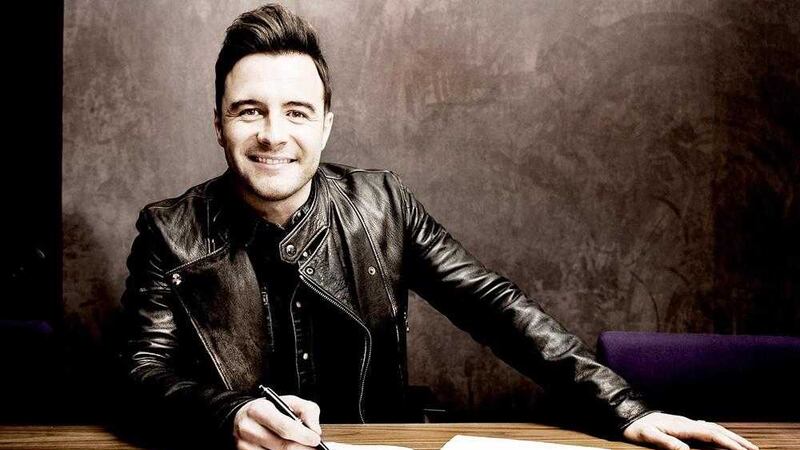

Westlife singer Shane Filan was among the highest-profile Irish person to follow the trend when he was declared bankrupt in Kingston county court in Surrey, a week after his Irish-based property development company went into receivership owing €5.5m (about £4m) to Ulster Bank and Bank of Ireland.