The UK economy took another small step towards avoiding recession on Thursday as new data showed it bounced back in August from strikes and poor weather the month before.

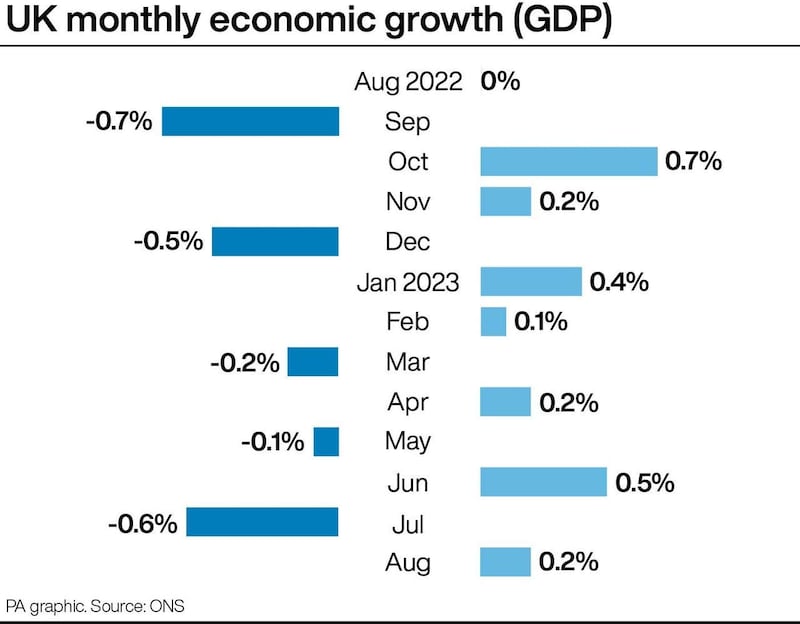

Gross domestic product (GDP) – which measures the value of goods and services produced – rose by 0.2% in August, compared to a 0.6% drop in July, the Office for National Statistics said. The July figure was also revised down from a 0.5% fall on Thursday.

ONS director of economic statistics Darren Morgan said: “Our initial estimate suggests GDP grew a little in August, led by strong growth in services which was partially offset by falls in manufacturing and construction.

“Within services, education returned to normal levels, while computer programmers and engineers both had strong months.”

It puts the UK one step closer to avoiding a recession this year, and could contribute to interest rates remaining unchanged next month.

The economy has to have grown by a similar amount in September as it did in August to ensure it remained flat in the third quarter. A recession is generally defined as two consecutive quarters of contraction.

Thomas Pugh, economist at consultancy RSM UK, said: “The rebound in the UK economy of 0.2% in August should allay fears that the UK is slipping into a recession.

“However, the strength was mainly due to the unwinding of the impact of public sector strikes in the health and education sectors in July and the awful weather that month which kept consumers at home.”

Underlying growth is still fairly flat, Mr Pugh said, which could help the Bank of England keep interest rates unchanged at 5.25% when its decision makers meet next month. Any serious growth might cause them to reconsider and hike rates further.

The news comes two days after the International Monetary Fund forecast the UK would have the weakest economic growth in the G7 next year due to pressure from higher interest rates.

Emma-Lou Montgomery, associate director for personal investing at Fidelity International, said the IMF warning “will still be ringing in many people’s ears”.

She added: “What happens to interest rates next will undoubtedly play a part. If, as financial markets seem to think, the Bank of England base rate has peaked at 5.25%, then maybe the IMF’s predictions will look weaker.

“But if previous higher forecasts come true, then it’s a different story. Because the difference between 5.25% and the previous peak forecast of 6% would be substantial in terms of its economic impact.”

August’s data showed some of the biggest gains for architects and engineers, with their sector growing by 4.7%. This helped the services sector grow by 0.4% overall in August, helping to boost GDP.

The education sector, which had shrunk 1.7% due in part to strikes in July, rose by 1.6% in August, the ONS said.

Not all parts of the service sector had a good month, however. The arts, entertainment and recreation sector shrank by 7.4%.

GDP grew 0.2% in August.

▪️ services grew 0.4%

▪️ production fell 0.7%

▪️ construction fell 0.5%

➡️ https://t.co/xRGyis2jY8 pic.twitter.com/TEooaUIyyi

— Office for National Statistics (ONS) (@ONS) October 12, 2023

The ONS also said it had downgraded July’s performance from a fall of 0.5% to a 0.6% drop.

The revision was in part due to the performance of consumer-facing service businesses. The output of companies had previously been thought to have been flat in July, but revised estimates show that the sector contracted by 0.2%.

It makes July’s fall the largest since June last year, when the Platinum Jubilee bank holiday calendar led to a fairly large drop in GDP.

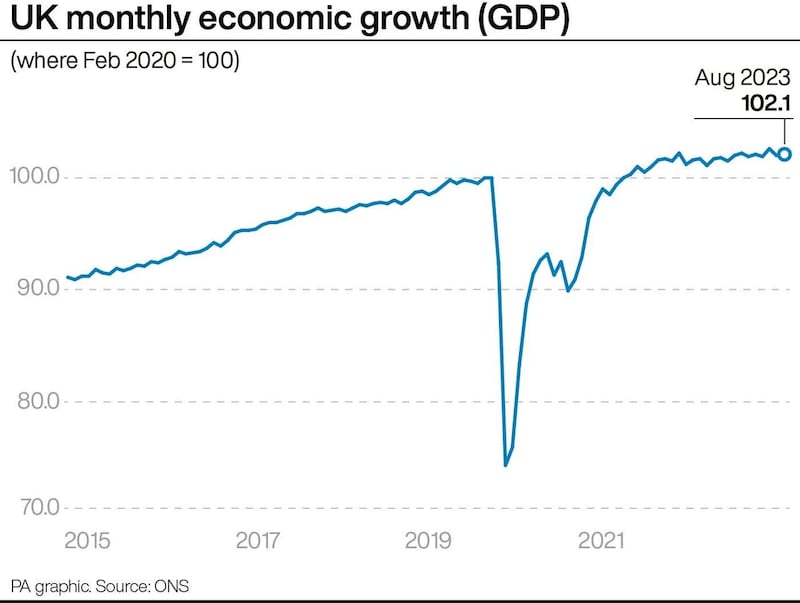

It means the UK’s economy is now 2.1% larger than it was in February 2020, before the Covid-19 pandemic hit.

Chancellor Jeremy Hunt said: “The UK has grown faster than France and Germany since the pandemic and today’s data shows the economy is more resilient than expected.

“While this is a good sign, we still need to tackle inflation so we can unlock sustainable growth.”

Labour shadow chancellor Rachel Reeves said: “Under the Conservatives, Britain’s economy remains trapped in a low growth, high tax cycle that is leaving working people worse off.

“Labour will get our country building again so we can boost growth, make working people better off and get Britain’s future back.”