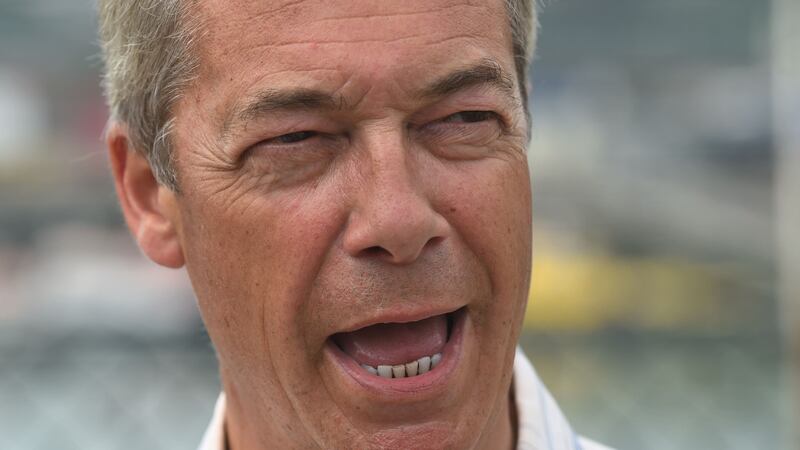

The chief executive of NatWest Group has apologised to Nigel Farage for “deeply inappropriate comments” made about him in official papers, saying she is “commissioning a full review of the Coutts’ processes” on bank account closures.

It comes after the former Ukip leader said his bank account was unfairly shut down by private bank Coutts, owned by NatWest Group, because it did not agree with his political views.

The NatWest Group has come under political pressure in recent days over the matter.

Dame Alison Rose said that the “deeply inappropriate comments made in the now-published papers prepared for the Wealth Reputation Risk Committee, do not reflect the view of the bank”, as she apologised to Mr Farage.

“No individual should have to read such comments and I apologise to Mr Farage for this.

“I have written to him today to make that apology and reiterate our offer of alternative banking arrangements.

“In addition, I am commissioning a full review of the Coutts’ processes for how these decisions are made and communicated to ensure we provide a better, more transparent experience for all our customers in the future.”

It comes after the Treasury announced that UK banks will be subject to stricter rules over closing customers’ accounts, under changes designed to protect freedom of expression.

The bank, which closed Mr Farage’s account earlier this year, cited his retweet of a Ricky Gervais joke about transwomen and his friendship with tennis player Novak Djokovic, who is opposed to Covid vaccinations, to flag concerns that he is “xenophobic and racist” in documents seen by MailOnline.

Dame Alison said: “Both freedom of expression and access to banking are fundamental to our society.

🚨Today the Government has acted to address fears that banks are terminating accounts because they disagree with someone’s political beliefs:

📆 The changes will increase the notice period to 90 days – giving customers more time to challenge a decision or find a replacement…

— Andrew Griffith MP (@griffitha) July 20, 2023

“It is not our policy to exit a customer on the basis of legally held political and personal views.

“Decisions to close an account are not taken lightly and involve a number of factors including commercial viability, reputational considerations and legal and regulatory requirements.

“I fully understand the public concern that the processes for bank account closure are not sufficiently transparent.

“Customers have a right to expect their bank to make consistent decisions against publicly available criteria.

“Those decisions should also be communicated clearly and openly with them, within the constraints imposed by the law.

“To achieve this, wider change is required. But the experience of clients highlighted in recent days has shown we need act now to put our processes under scrutiny.”

The disclosures prompted a swift response from ministers, with new changes meaning that banks will have to explain why they are shutting down someone’s account.

They previously have not had to provide a rationale for doing so.

The Government said it was stepping in to protect freedom of expression, over concerns that a person’s political views were being used as a reason for lenders to shut down their account.

The changes will not take away a banking firm’s right to close accounts of people deemed to be a reputational or political risk.

Instead, it will boost transparency for customers, therefore making it easier for them to appeal against the decision, the Treasury said.

It also extended the notice period for a forced account closure from 30 days to 90 days under the new rules.

This will give customers more time to challenge the decision through the Financial Ombudsman Service or find a replacement bank, it said.

Andrew Griffith, economic secretary to the Treasury, said: “Freedom of speech is a cornerstone of our democracy, and it must be respected by all institutions.

“Banks occupy a privileged place in society and it is right that we fairly balance the rights of banks to act in their commercial interest with the right for everyone to express themselves freely.

“These changes will boost the rights of customers, providing real transparency, time to appeal and making it a much fairer playing field.”

The closure of Mr Farage’s accounts sparked outrage among senior Tory MPs, who had piled pressure on Coutts and its owner NatWest.

Prime Minister Rishi Sunak had made plain his view that “no-one should be barred from using basic services for their political views”.

Mr Farage had earlier praised the Government response, as he said MPs are “beginning to realise that this system is coming for them as well”.

He told the PA news agency that there is “a real sense of anger” among the public, who bailed out banks during the 2008 financial crisis, that they “can now treat us with contempt”.