House hunters relying on a mortgage will potentially have less purchasing power and less confidence as a result of Thursday’s base rate increase, according to property experts.

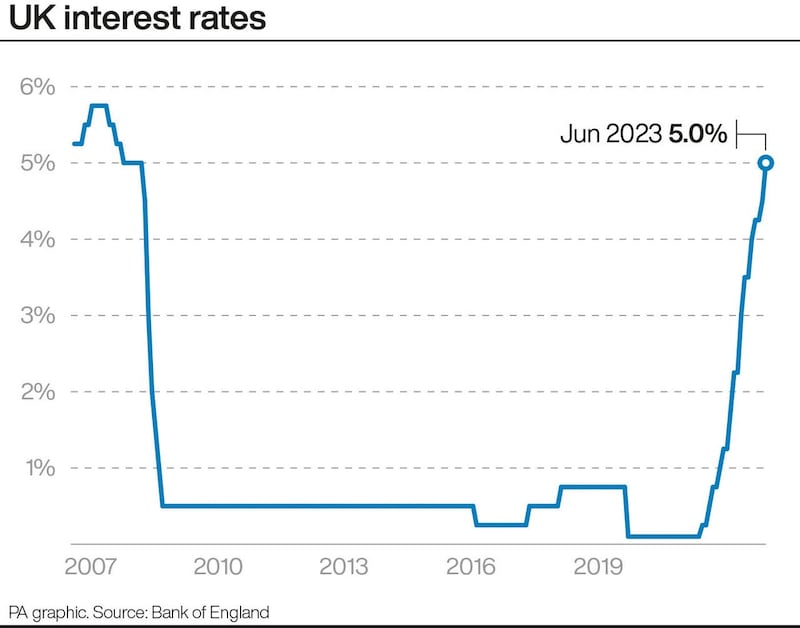

As the Bank of England pushed up the base rate to 5%, the highest rate in nearly 15 years, in a bid to ease stubbornly high inflation, experts said that the housing market was seeing a shift towards more “realistic” prices.

Some also suggested the rate hike could push some landlords into selling up, which could help increase the supply of homes for buyers but put a further squeeze on the rental market.

Jeremy Leaf, a north London estate agent and a former residential chairman of the Royal Institution of Chartered Surveyors (Rics), said: “The green shoots apparent in the housing market at the beginning of the year have started to wilt, despite continuing support from strong employment figures.

“It seems confidence to buy property will only begin to return when core inflation drops to more sustainable levels over a longer period.”

Matt Thompson, head of sales at London-based estate agent Chestertons, said: “We expect the rate rise to have an impact on over-leveraged buy-to-let investors whose increased mortgage payments could lead to their investment making limited profit or even a loss.

“This could result in some landlords deciding to offload their assets.

“At this stage, we haven’t yet encountered homeowners who have been forced to sell up but, if rates continue to rise, some owners may be forced to review the situation and weigh up their options.

“At the same time, demand for properties in London continues to stay strong as the capital remains a hot spot for a variety of buyer demographics including international buyers.”

Nathan Emerson, chief executive of property agents organisation Propertymark, said: “It’s undisputed that homeowners and first steppers will be facing the consequences of rising interest rates as borrowing costs increase.

“However, with this comes a further shift towards more realistic and sustainable house prices, down from the spike seen during the pandemic.”

In better news for buyers, Mr Emerson said recent increases seen by the body in the supply of homes would provide buyers with more room for negotiation, as well as more choice.

Earlier this week, Rightmove reported that the average price tag on a newly marketed home in Britain fell by £82 in June, marking the first monthly decrease seen in 2023.

In further signs of a cooling market, the Office for National Statistics (ONS) also reported this week that the average UK house price in April this year was £7,000 below a recent peak in September 2022.

Kundan Bhaduri, director of London-based property developer and portfolio landlord at the Kushman Group, said: “This latest hike, without a doubt, could slow down the property market as potential buyers scuttle away.”

Gary Bush, financial adviser at Potters Bar-based MortgageShop.com, said: “The London and South East property markets will slow to a grinding halt now I think.”

Jason Tebb, chief executive of property search website OnTheMarket.com, said: “The 13th rate rise in as many meetings will further exacerbate increasingly stretched affordability and is set to have a negative impact on the confidence of the average property seeker relying on a mortgage.”

He added: “Serious buyers and sellers continue to engage with each other, but with the former having potentially even less purchasing power after today’s announcement, the sensible pricing of property coming to market is essential.”

Rightmove’s mortgage expert Matt Smith said: “If today’s news does provide some reassurance to the markets, then we’d hope to see some stability return to the mortgage market which will help those looking to take out a mortgage this year to plan ahead.

“Our real-time data still shows that more people are sending inquiries to estate agents to view homes for sale than at this time in 2019.

“We’ve also seen daily visits to our mortgage-in-principle service increase by 53% over the last month, as more people look to understand what they can afford to borrow and repay on a mortgage.

“This indicates to us that for many people right now, higher interest rates are leading them to assess their budgets and what they can afford, rather than put their plans on hold.”