UK interest rates could be cut by the Bank of England as soon as this summer, according to its deputy governor.

Ben Broadbent, deputy governor of the central bank, said in a speech on Monday morning that it is “possible” borrowing costs will come down this summer if the economy evolves as expected.

The UK interest rate currently sits at a 16-year-high of 5.25% after it had been increased by the Bank of England’s Monetary Policy Committee (MPC) over the past two years in a bid to tackle inflation.

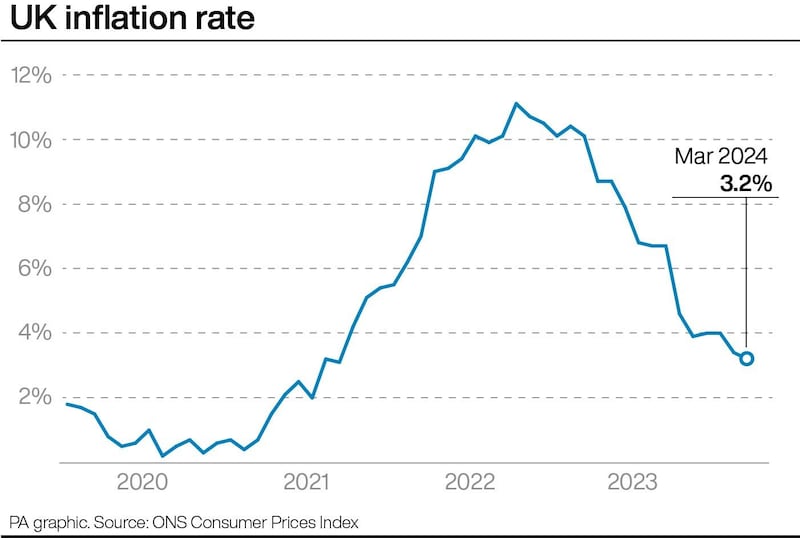

CPI (Consumer Prices Index) inflation has since dropped to 3.2% for March, compared with the previous year, and is predicted to drop towards the 2% target rate in the coming months.

The economist said the Bank’s nine-strong MPC, which votes on potential interest rate increases, must assess how potential persistence around wage and services inflation are continuing to develop.

He added: “Whatever the priors of its individual members the MPC will continue to learn from the incoming data and, if things continue to evolve with its forecasts – forecasts that suggest policy will have to become less restrictive at some point – then it’s possible the bank rate could be cut some time over the summer.”

Mr Broadbent will be replaced in his role by Clare Lombardelli, chief economist for the Organisation for Economic Co-operation and Development (OECD), on July 1.

He will vote for the final time during the interest rates decision in June, with another vote set to take place in August.

Earlier this month, Mr Broadbent was among those to vote for interest rates to remain at 5.25%, with a 7-2 vote in favour of no change.

The financial markets have priced in a reduction to interest rates by August.