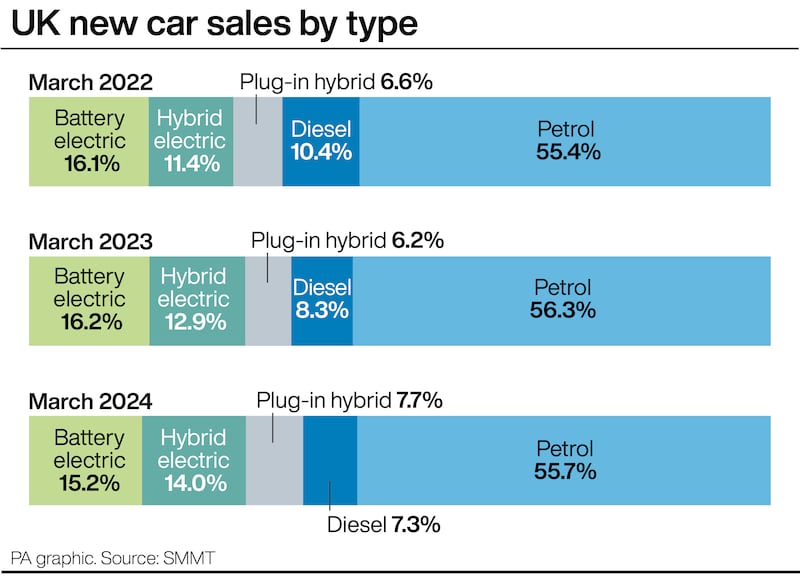

The automotive industry issued renewed pleas for electric car purchase incentives after new figures showed a decline in the vehicles’ market share.

Some 15.2% of new cars registered in March were pure electrics, down from 16.2% during the same month last year, the Society of Motor Manufacturers and Traders (SMMT) said.

The industry body urged the Government to halve VAT on the purchase of new electric vehicles (EVs), amend plans to introduce vehicle excise duty for EVs, and reduce VAT on public EV charging to bring it into line with home charging.

Under the Zero Emission Vehicle (ZEV) mandate, at least 22% of new cars sold by each manufacturer in the UK this year must be zero-emission, which in most cases means they are pure electrics.

The threshold will rise annually until it reaches 100% by 2035.

Manufacturers who fail to comply or make use of flexibilities – such as carrying over allowances from previous years or purchasing credits from rival companies – will be required to pay the Government £15,000 per polluting vehicle sold above the limits.

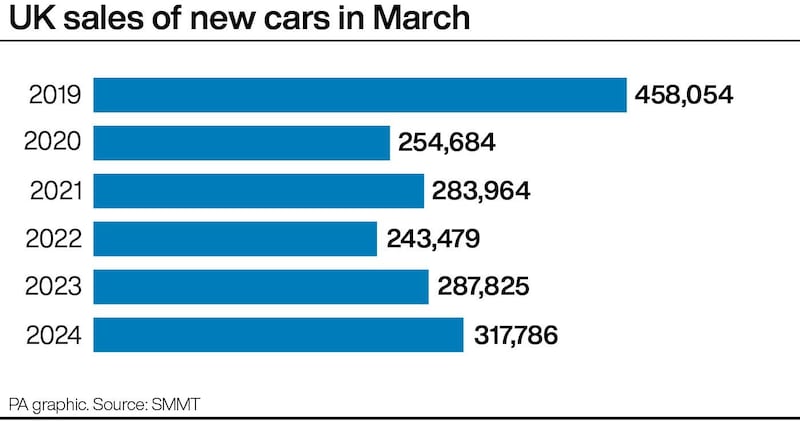

The overall new car market saw 317,786 registrations last month.

That is an increase of 10.4% compared with March 2023.

Growth was driven by purchases for large fleets (up 29.6%), while demand from private buyers fell by 7.7%.

SMMT chief executive Mike Hawes said: “Market growth continues, fuelled by fleets investing after two tough years of constrained supply.

“A sluggish private market and shrinking EV market share, however, show the challenge ahead.

“Manufacturers are providing compelling offers, but they can’t single-handedly fund the transition indefinitely.

“Government support for private consumers – not just business and fleets – would send a positive message and deliver a faster, fairer transition on time and on target.”

Earlier this week EV manufacturer Tesla reported a fall in global sales of nearly 9% during the first three months of the year compared with the same period in 2023.

Produced our 6 millionth car!

Thank you to our owners & teams around the world for your support & hard work—it truly matters.

🌎🌍🌏❤️ pic.twitter.com/F4IeQtK0PS

— Tesla (@Tesla) March 29, 2024

Ian Plummer, commercial director at online vehicle marketplace Auto Trader, said: “Sales of electric vehicles are still rising, despite the gloom from Tesla.

“While the fleet side of the market is driving the growth, more needs to be done to stimulate electric vehicle demand among private buyers where affordability remains a barrier.

“That said, manufacturers are fighting harder than ever to tempt customers, as more than three-quarters of new EVs are now advertised on our platform with discounts.

“That trend only looks set to accelerate as manufacturers struggle to meet strict ZEV mandate targets in a much more competitive landscape.

“The arrival of new Chinese entrants is likely to continue to shake up the market and bring down prices for consumers.”

Alex Buttle, co-founder of used car selling comparison website Motorway.co.uk, said: “The Government still needs to do more to encourage private buyers to make the leap to electric.

“Greater charging infrastructure and tax incentives are what the industry needs to really power up the private EV market.”