Business conditions in the north’s private sector largely improved at the start of 2024, a new survey from Ulster Bank suggests.

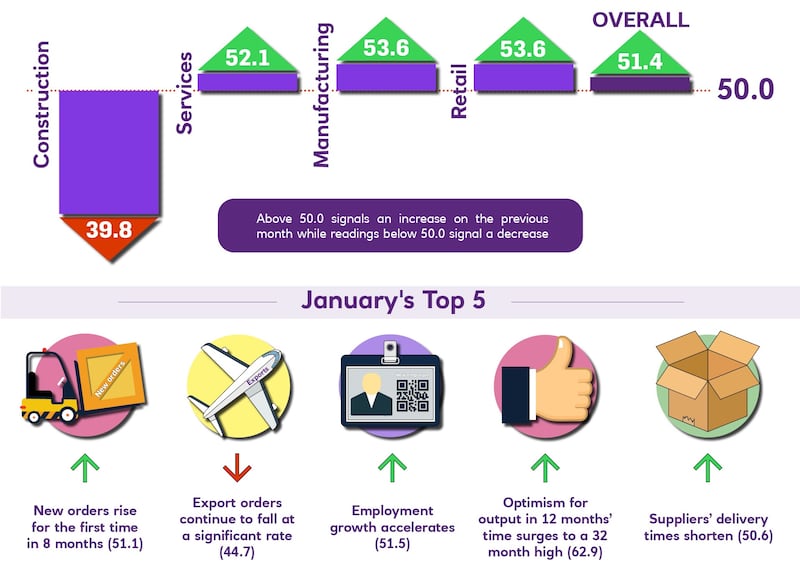

The latest purchasing managers’ index (PMI) from the lender showed businesses reporting increases in new orders for the first time in eight months.

Output increased in the services, manufacturing and retail sectors during January, with construction the notable exception.

Activity in the construction sector fell at the fastest pace in 12 months.

Despite the continued woes within the building sector, the monthly survey showed business optimism at its highest point in Northern Ireland for almost three years, driven by the launch of new products and higher orders.

Based on the experiences of 200 businesses across the north’s construction, manufacturing, retail and services sectors, the PMI is considered a trusted litmus test for the performance of the economy here.

Ulster Bank’s chief economist, Richard Ramsey, said: “Significantly, the notable improvement in the outlook predates the restoration of Stormont.

“The impact on sentiment of the political developments should become apparent in February’s survey.”

He said despite a continued slump in export orders, a notable pick-up in domestic demand in January’s PMI led to the first rise in new orders in eight months.

“A surge in retail demand and a return to growth in manufacturing orders more than offset the continued declines in services and construction,” said the economist.

January’s survey also showed inflationary pressures moderating.

Despite the re-routing of shipping lanes away from the Suez Canal creating longer delivery times and some increased costs, January PMI showed input cost inflation eased to a six-month low.

“Staffing levels continued to rise with manufacturing (marginally), services and construction firms all increasing their headcounts,” continued Mr Ramsey.

However, retailers reduced their staffing levels for the first time in 16 months.

Meanwhile, a separate consumer sentiment survey published on Monday from also showed some signs of improvement.

New research from the Credit Union said consumer confidence in Northern Ireland improved marginally between November and January, sustaining a gradually improving trend through the past twelve months.

But the report said the worries of northern consumers are far from over.

The Credit Union said while there has been some softening in fuel prices of late, cost-of-living pressures remain elevated and recent public sector strikes serve both to emphasise the ongoing squeeze on households spending power as well as a difficult ‘macro’ climate.

As a result, sentiment among Northern Ireland consumers remains cautious and it has not improved to the same degree as it has for their counterparts in the Republic or Britain.

Economist Austin Hughes, who oversaw the latest research, said while consumers in the north are less nervous than they were one year ago, the strength of the labour market during 2023 had not translated into mainstream thinking.

Almost half (48%) of those surveyed believe the financial situation of their household is worse now to what it was 12 months ago, while 42% feel that the financial position of their household will worsen in the next 12 months.

“My sense is that the smaller uptick in consumer sentiment in Northern Ireland than elsewhere of late may owe something to a less pronounced easing in fuel costs, as well as the sharp focus that recent public sector strikes have put on living cost pressures, and the difficulties arising from the two-year hiatus when power sharing was suspended,” said Mr Hughes.

“However, fears are gradually easing. Although more consumers still expect unemployment to rise than think it will fall, the balance of thinking on the outlook for jobs is far less negative than it was twelve months ago.”

Martin Fisher, manager for the Irish League of Credit Unions in the north, said he was encouraged by the signs of improving consumer sentiment.

“The pickup in spending that we see in the survey is also reflected in the increased enquiries credit unions are getting as people begin planning their summer holidays,” he said.

“Our survey was conducted prior to the restoration of the Northern Ireland Assembly, which I expect will impact positively on consumer confidence and it will be interesting to see how that will be reflected in our next quarterly survey.”