THE north's economy is a vice-like grip of its most severe contraction in centuries as output, new orders and job numbers nose-dived in April in the manufacturing and services sector.

And with prospect of the worst recession in living memory, one in 10 firms in the north are at high risk of going to the wall, while young people are facing a jobless disaster which could scar the long-term prospects of a whole generation.

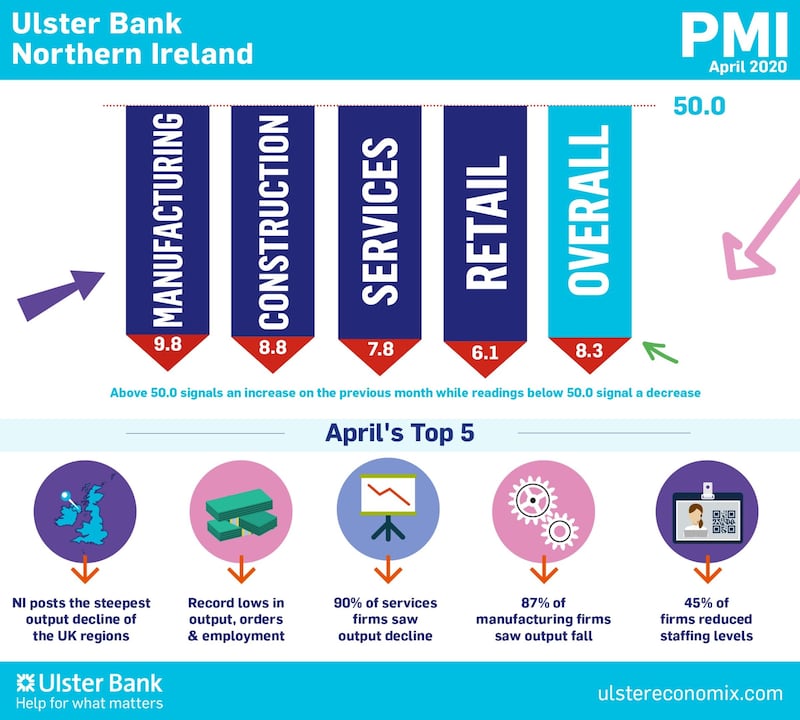

Figures in the latest Ulster Bank PMI survey - the first fact-based indicator of regional economic health each month - underline the extent and severity of the coronavirus pandemic-led slump in April.

In data covering the first full lockdown month, all UK regions posted record rates of decline in output and employment, with Northern Ireland worst of the lot, with an additional raft of record rates of decline in new orders, exports, backlogs and business confidence.

However, the north’s rapid rate of decline in employment was not as sharp as most other UK regions, with evidence suggesting the region's uptake of the government's Job Retention Scheme – and the process of furloughing staff – has been notably higher than the national average.

Just over half (52 per cent) of local firms left workforce numbers unchanged, yet despite the unprecedented levels of government job support, employment is still falling at a record pace, with 45 per cent of firms confirming they reduced their headcount in April.

The PMI reading for Northern Ireland was again revised way lower in April to less than 10 (a reading under 50 represents a contraction while over 50 indicates growth).

Ulster Bank's regional chief economist Richard Ramsey said: “Until this pandemic struck, figures in the 20s were extremely rare. But post the start of Covid-19 we've seen PMI readings around the world fall into the teens and even a few into single digits.

“Northern Ireland’s headline indicator of business activity collapsed to 8.3 last month. All four monitored sectors recorded business activity readings below 10.

“So what does this actually mean? Well, prior to Covid-19, the lowest-ever reading for business activity in Northern Ireland was 32.1 in January 2009.

“The scale of the collapse in demand in April relative to 2009 is clear when looking at the proportion of firms reporting a fall in output.

“Around 87 per cent of manufacturing firms and 90 per cent of service sector firms reported a decline in output in April relative to March. In January 2009 the corresponding percentages were 44 per cent (manufacturing) and 48 per cent (services), so the speed and scale of the current slump is of a much greater magnitude than the last recession.”

Mr Ramsey believes April will be the low watermark in all of the UK PMI surveys, as private sector growth will begin again in May, albeit from an extremely low base.

“We can expect to see some strong rates of output growth in the coming months, but this must be interpreted with caution. The key point is that actual levels of activity will remain extremely weak for some time.

“Returning to the levels of private sector activity and employment that existed before the pandemic will take years not months. Covid-19 will leave scars on the economy that will last even longer.”

Following prime minister Boris Johnston last night setting out his roadmap for easing the lockdown, the north's business community is now seeking detailed information on a fiscal plan for recovery.