THE rate of unemployment in Northern Ireland may have reached a record low, an influential new business survey suggests.

The north’s official unemployment rate was estimated at 2.4 per cent in the three months to February, just shy of the 2.3 per cent record.

But the latest analysis from Ulster Bank suggests the private sector increased staffing levels at significant rates in the two months subsequent.

The lender’s monthly purchasing managers’ index (PMI) found the rate of job creation in Northern Ireland during March reached the joint record high from the 20-year series.

The latest report said job creation rates in April remained “marked”.

The monthly survey, which is based on the experiences of 200 businesses across the north’s construction, manufacturing, retail and services sectors, is considered a reliable bellwether for the state of the economy.

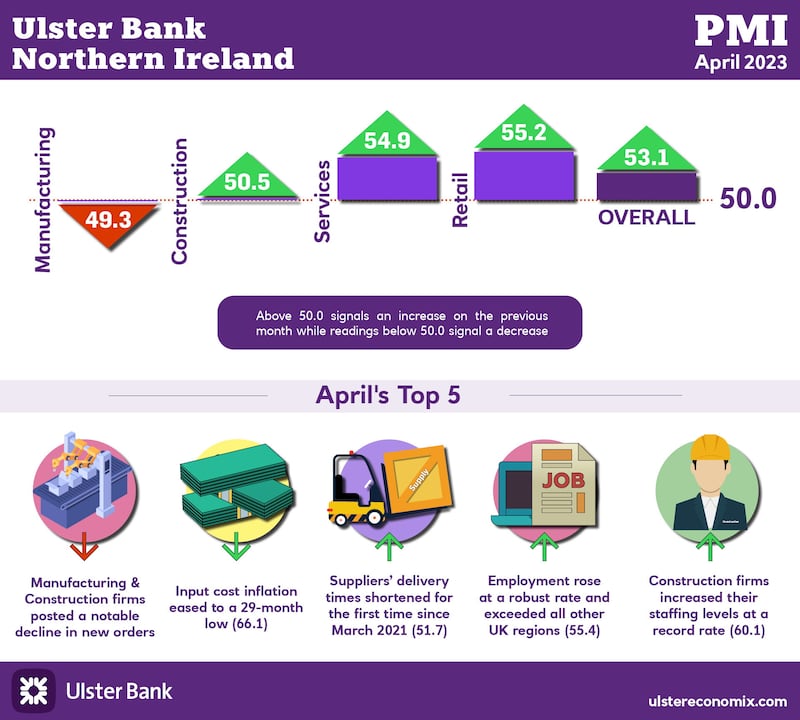

April’s PMI showed the Northern Ireland private sector remained in growth mode, albeit at a slower rate than March.

Retail and services were the key drivers in last month’s growth, with construction recording a rise in activity for the first time in 14 months. Manufacturing was the only sector to report a decline.

Ulster Bank’s report said the rising rates of employment was the result of a combination of rising new orders and companies trying to work through outstanding business.

The lender’s chief economist, Richard Ramsey said that despite robust rates of wage inflation, all sectors continued to increase their staffing levels in April.

“Retailers led the way in the recruitment drive, but construction firms posted a record rise in staffing levels,” he said.

“This would appear to suggest the softer demand in the sector is enabling longstanding vacancies to finally be filled.”

Although prices are continuing to rise for businesses, April’s PMI showed inflationary pressure is continuing to soften.

Input costs for the private sector rose at the weakest pace in nearly two-and-a-half years, which was in turn reflected in the prices businesses charged.

"Overall, the steady improvement in the private sector is in stark contrast with the mounting difficulties within the public sector,” said Richard Ramsey.

“Budget cuts and a scaling back of public services will also have implications for parts of the private sector too.

“Meanwhile the headwinds of higher interest rates and increased taxation will increasingly be felt by all parts of the economy in the year ahead."