CONSUMER sentiment in Northern Ireland has shown clear improvement since the start of the year, according to a new Credit Union survey.

Research carried out by the Irish community-based lender during April found much less negativity compared to January.

Some 350 adults from Northern Ireland took part in the study.

The economist Austin Hughes, who compiled the research, said consumer confidence in Northern Ireland remains subdued, but notably stronger than in January.

“It is not surprising that Northern Ireland consumers are concerned regarding the general economic outlook and their own household finances,” he said.

“We would interpret the combination of responses as indicating that Northern Ireland consumers feel economic and financial conditions have not deteriorated nearly as much as previously feared, rather than any pointer that markedly more favourable conditions have taken hold of late.

“It remains the case that many Northern Irish consumers face serious cost-of-living pressures and/or an uncertain economic future.”

Separate research published by Asda on Wednesday suggests that the discretionary income of households in the north have taken a battering over the past year.

Asda’s latest income tracker identified Northern Ireland as the weakest performing UK region for the seventh consecutive quarter.

The report suggests the average household here had just £100 per week for discretionary spending in the first quarter of 2023, £27 (21 per cent) less than 12 months ago.

Meanwhile, the new survey from the Credit Union showed that while the consumer outlook is less negative, households are unable or unwilling to translate it into spending yet.

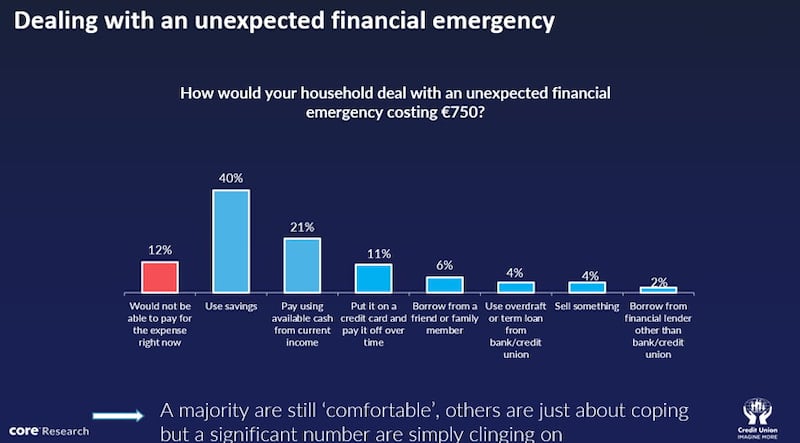

The Credit Union also asked northern households how they would respond to an unexpected financial emergency costing £750.

Just one-in-five (21 per cent) said they would have the cash available to cover it. Some 40 per cent said they would need to dip into savings, while 23 per cent would resort to some sort of borrowing or credit facility.

Some 12 per cent of the survey respondents said they could not afford to pay the £750.