DESPITE crippling inflation in the second half of the year, the Northern Irish grocery market saw sales grow by 1.3 per cent over the last 12 months, with shoppers spending an additional £45.3 million, according to new figures from analysts Kantar.

Average food and drink prices were up 7.1 per cent compared to the year before, and grocery inflation in January was running at 11.4 per cent.

“That means the average annual grocery bill is set to rise by £553 from £4,849 to £5,401 if shoppers don’t change their behaviour to cut costs," according to Emer Healy, senior retail analyst at Kantar.

“As households look for ways to manage costs, many are turning to cheaper alternatives such as retailer own-label lines, with shoppers spending £27 million more than last year, and specifically to value own label products with sales up 23 per cent and shoppers spending £5.3 million more."

She said that over the latest 12 weeks, grocery sales rose 5.6 per cent, driven by a 10.6 per cent increase in average prices.

And as shoppers here began the year with a health kick, they spent an additional £1.4m on chilled prepared salads and £1.2m more on frozen vegetarian products.

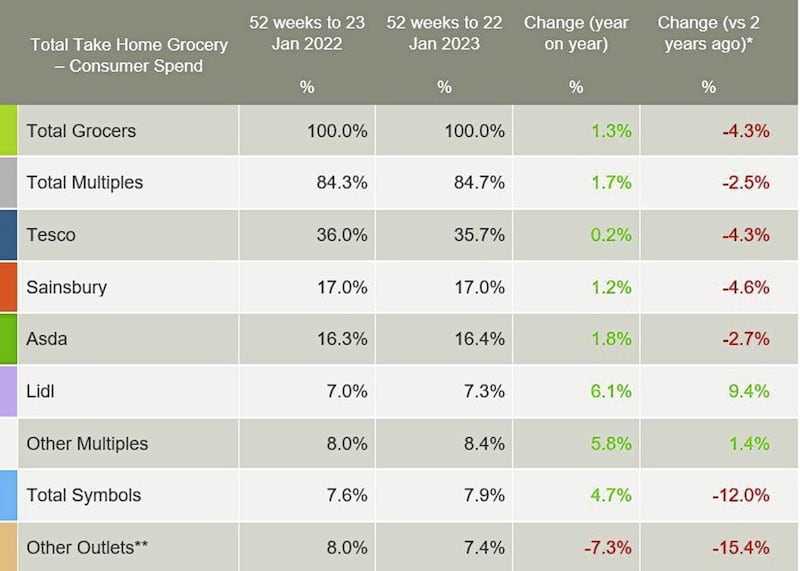

The Kantar data shows that Tesco maintained its position as the north’s largest grocer with a 35.7 per cent share of the market. It welcomed an influx of new shoppers in store alongside more frequent trips which contributed an additional £58m to their overall performance.

Sainsbury’s holds a 17 per cent market share and saw a boost of new shoppers which contributed an additional £31.3m to their overall performance while Asda commands 16.4 per cent of the market this period, having new and existing shoppers purchasing more often, which contributed an additional £16.2m overall.

Lidl now has a 7.3 per cent market share, up 6.1 per cent year-on-year, thanks to new shoppers and more frequent trips which contributed £18.4m to its overall performance.