Falling inflation in the north’s grocery sector is finally being reflected around the breakfast table - but only just.

For while the prices of butter, milk and bacon have fallen, consumers are still paying more for eggs, sausages, tea and bread.

And when that’s all melted down into Ulster Bank chief economist Richard Ramsey’s Ulster Fry index, his annual barometer of price change of items that comprise a traditional cooked breakfast, it still means households are paying more than in most years since the inception of the series.

The index - published to coincide with the bank’s reaffirmation of its sponsorship of the Balmoral Show (which it has now supported for 15 years) - is seen as a useful way of engaging consumers in economics and help communicate what’s happening with inflation.

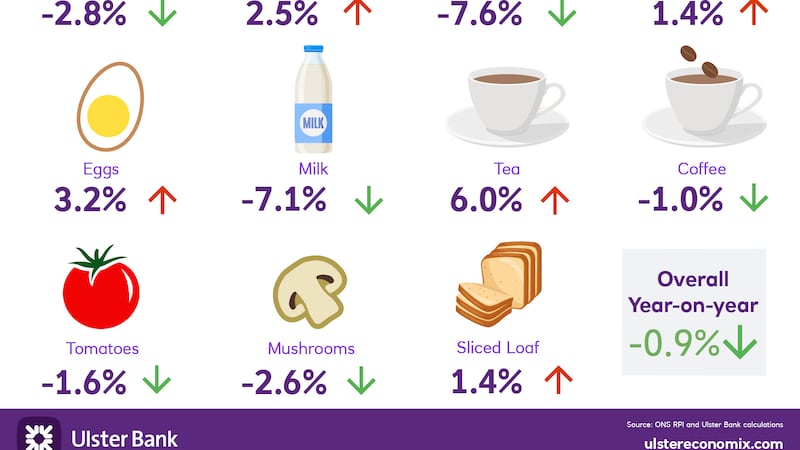

Overall, the Ulster Fry index is just 0.9% lower than the 2023 figure, the highest increase recorded since Ulster Bank began tracking the index in 2007. The previous highest rise came in 2009, just after another recession and cost of living crisis.

Tea saw the biggest price increase, rising 6% in the year to February, though this was slightly offset for brew lovers with a 7.1% fall in milk prices. Rises were also recorded in pork sausages (2.5%), eggs (3.2%) and sliced loaf (1.4%)

On the flip side, prices came down for butter (-7.6%), bacon (-2.8%), mushrooms (-2.6%), tomatoes (-1.6%) and coffee (-1%).

Mr Ramsey said: “We know food makes up a significant proportion of household spending and is one of our most important economic drivers in terms of the local food and drink industry.

“What the Ulster Fry index is telling us is that while the price of some everyday household essentials have fallen, there continues to be a squeeze on consumer spending powers.

“While that is good news, the reality is that many of these price decreases are too small and insignificant to fully register at the checkout and it’s clear that many households are still struggling to contend with ongoing cost pressures on what would be considered as basic everyday household items.”

Ulster Bank’s senior agriculture manager Cormac McKervey, who also addressed the media breakfast, said that while inflation may have eased in recent months, there are always ongoing issue impacting farm businesses.

He said: “Twelve months ago the agrifood sector was dealing with financial pressures brought about by rising input costs and falling milk prices. Despite some of the financial burdens easing, many farmers are still operating in challenging times particularly the weather.

“Continuous high rainfall throughout late 2023 and early 2024 has had a worrying impact and will cause difficulties for lambing and calving, for arable farmers trying to plant spring crops, and interrupt the fertilising schedule for those involved in silage production. All of this may cause cash flow issues.

“But there are shoots of optimism and it’s important that farmers don’t lose sight of opportunities. Land and livestock prices remain strong and stable and falling grain prices have helped farmers livestock farmers to maintain or increase their margins.”