The north’s all-important services sector slowed in the final three months of 2023, official data shows.

The index of services, compiled by the Northern Ireland Statistics and Research Agency (Nisra), contracted by 0.3% in the fourth quarter (Q4) of last year.

The sector, which encompasses business services, banking, retail and hospitality, accounts for just over half of the Northern Ireland economy.

The slowdown came despite the ongoing boom among business services and finance sub-sector, which has grown by 29% since the end of 2019.

NI Index of Services Quarter 4 2023 released today https://t.co/l6ddrDihh1 pic.twitter.com/4uqel7HYhN

— NISRA (@NISRA) March 14, 2024

The UK services sector contracted by 0.2% the final three months of 2023, a period in which the Office of National Statistics declared the UK economy had entered a technical recession.

The threshold for a technical recession was crossed after UK gross domestic product (GDP) contracted in both the third and fourth quarters of 2023.

Nisra’s own measure of output suggests the north’s economy did not contract in the same way as the wider UK economy in the third quarter of 2023.

The NI Composite Economic Index (NICEI), which is the closest thing Nisra has to measuring GDP, grew by 0.6% in Q3 2023.

The NICEI for Q4 2023, which will also measure public sector output, is due to be published at the end of this month.

It’s unclear whether the contraction in services output will pull the entire NICEI into negative territory.

A separate report released by Nisra on Thursday, charting the performance of the manufacturing sector, showed not all areas of the private sector contracted in Q3 2023.

The index of production grew by 0.4% between the third and fourth quarters of last year.

That was largely driven by the performance of manufacturing firms (+0.7%) and the quarrying and mining sector (+3.3%).

Despite the quarterly growth, the index of production (IOP) ended 2023 3.3% smaller than the end of 2022, while the UK IOP was 0.1% up.

But the north’s IOP has grown by 1.1% since Q4 2019, while the UK index contracted by 8.7% in the same period.

NI Index of Production Quarter 4 2023 released today https://t.co/D2gYXgjnmN pic.twitter.com/8KmVwJmoet

— NISRA (@NISRA) March 14, 2024

Ulster Bank chief economist Richard Ramsey said the IOP conceals huge variation at sub-sector level.

He said the machinery and equipment sub-sector, which includes Mid Ulster’s quarrying, screening and crushing machinery manufacturers, has grown by 39% since Q4 2019.

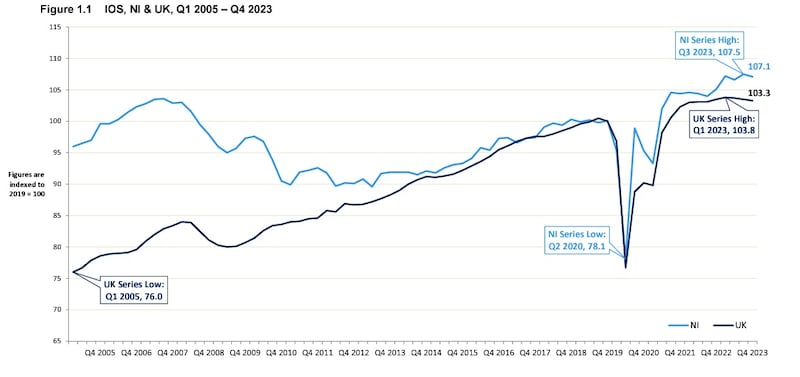

Nisra’s analysis also suggests the north’s services sector has outperformed the UK since the Coronavirus pandemic.

Services output in Q4 2023 was 1.9% up over the year in Northern Ireland, compared to a 0.2% contraction UK-wide.

The north’s services output is now 7% above pre-pandemic levels, while UK services output is 3.3% up.

Mr Ramsey the latest services index also highlighted some contrasting fortunes.

Business services and finance firms saw output rise 1.4% in the final quarter of last year, leaving them 8.9% up over the year and 29% above pre-pandemic levels.

On the other hand, the retail sales index contracted by 0.7% in the final quarter of 2023.

‘Other services’, which includes the arts, entertainment, recreation and personal services, deceased by 5.5% in Q4 2023.

But the sub-sector, which includes things like dental and private healthcare had hit a record high in the previous quarter (Q3 2023).