THE north’s retail and services sector suffered significant contractions last month on the back of the latest Covid-19 restrictions, new analysis from Ulster Bank has shown.

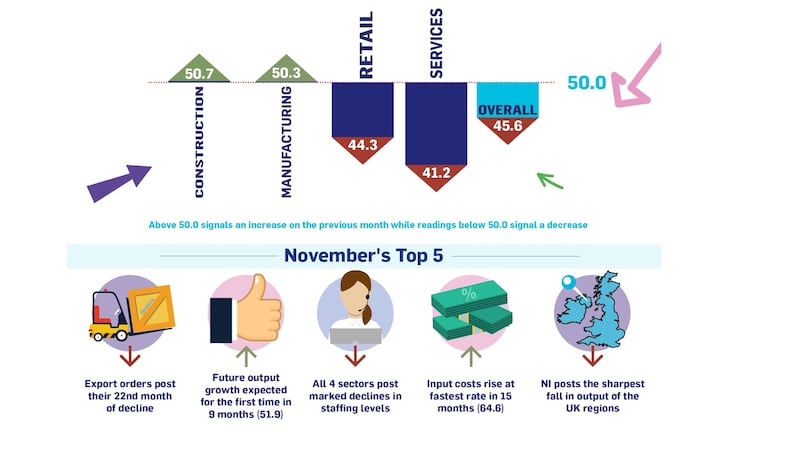

The lender’s Purchasing Managers' Index (PMI) for the month of November reflected a marked reduction in overall private sector output, with Northern Ireland firms continuing to report declines in new orders while costs continue to increase.

The analysis, compiled by IHS Markit, is based on the experiences of 200 private sector firms.

It found despite marginal improvements in the manufacturing and construction sectors during November, the overall index was dragged down by rapid rates of decline in output, orders and employment across retail and services businesses.

Both sectors felt the brunt of the latest lockdown on hospitality, retail and close contact premises last month.

READ MORE: Barometer reveals micro businesses distress and urges 'integrated enterprise strategy'

Conversely, the survey found the news of a Covid-19 vaccine during November resulted in the first signs of improved optimism in the business community for nine months.

However, that improved outlook was largely constrained to manufacturers and construction firms, with retail and services firms still understandably downbeat on their outlook for the next 12 months.

Ulster Bank’s chief economist, Richard Ramsey, said the weak figures on new orders signalled that no meaningful improvement in private sector activity can be expected in the near-term.

He said that output and orders among local firms fell at the fastest and joint-fastest rates of all the UK regions, while demand from export markets, notably the Republic, continues to weaken at a much faster pace than the domestic market.

“With the end of the Brexit transition rapidly approaching, the implications of a UK-EU deal/no-deal will have a major bearing on business performance and confidence in 2021 and beyond,” said the economist.

“Meanwhile lockdowns aren’t yet consigned to the past and will impact on economic growth next year as well.

“A successful roll out of vaccines though could make 2021 a year of two very different halves for those sectors that have been most impacted by the restrictions.”

RICHARD RAMSEY COLUMN: GREEN LIGHT AT THE END OF THE TUNNEL?