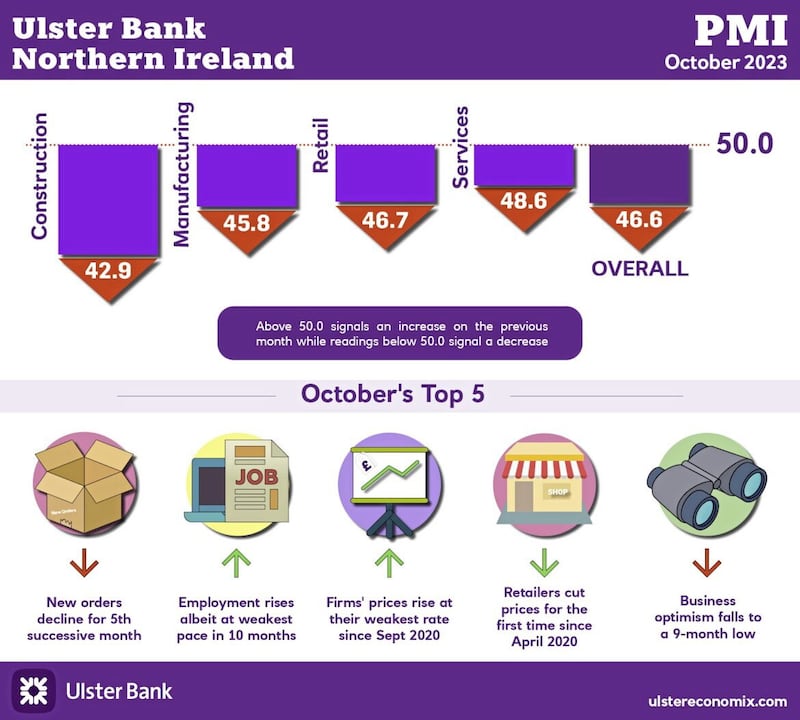

ACTIVITY in the north’s private sector continued to slow down in October, a new survey suggests.

The latest purchasing managers’ index from Ulster Bank recorded the fastest decline in new orders for local firms since January.

Although based on the experiences of just 200 businesses, the PMI is considered a trusted bellwether for the state of the north’s construction, manufacturing, retail and services sectors.

Published today, the report showed business activity falling for the fourth consecutive month in October, with activity contracting across all four sub-sectors.

Compiled by S&P Global for Ulster Bank, the PMI said the feedback from firms suggest the combination of higher interest rates and a lack of government at Stormont had impacted negatively on both business activity and new orders last month.

Despite the loss in momentum at the start of the fourth quarter, private sector firms still appear to creating jobs, albeit at the softest pace in ten months.

Read more:

- NI Chamber's plea: ‘When do we get our government back?'

- PwC: Northern Ireland economy to grow by 0.6% in 2023

Ulster Bank’s chief economist, Richard Ramsey, said while firms appeared to being doing their best to limit price rises, their order books contracted for the fifth month running.

“Indeed in the manufacturing and retail sectors, businesses were actually cutting their prices during October,” he said.

“Overall, prices charged by businesses rose at their weakest pace in around three years.”

"As a result of falling demand and challenging conditions, firms in the manufacturing and retail sectors are scaling back their optimism and construction firms expect to still be mired in recession in a year’s time,” he said.

The PMI suggests business confidence in the north hit a nine-month low in October.

Sentiment in Northern Ireland was the lowest of the 12 monitored areas of the UK, although firms on balance expect output to increase over the coming year.

"Positives were few and far between in the latest survey,” continued Mr Ramsey.

“The month of October was bookended with two unwanted developments; the outbreak of war between Israel and Gaza and localised flooding in Northern Ireland.

“Both of these developments add to a growing list of economic headwinds.

“Looking ahead, we have the Chancellor's autumn statement on November 22," added the economist.

“However expectations that he will provide a fiscal boost to businesses or households are extremely low."

A more upbeat report published by PwC on Thursday predicts Northern Ireland will finish 2023 as the best performing region of the UK outside London.

The financial services giant predicts the north’s economy will grow by 0.6% this year, citing the Windsor Framework and size of the public sector here as key factors.

It will likely be March 2024 before the official measure of the north’s economy for 2023 is published.

The NI Composite Economic Index (NICEI) suggests the economy grew by around 1.2% in the first quarter before contracting by 0.5% in the second quarter of this year.

That was largely down to a slowdown in the private sector.

Output in the economy in the second quarter was still 1.7% higher than the second quarter of 2022 and 5.8% above the pre-pandemic level seen in the fourth quarter of 2019.

Meanwhile, the Northern Ireland Statistics and Research Agency (Nisra), who compile the index, has confirmed it will reduce some of its output and suspend some work due to a 20% cut to its budget.

While some more obscure reports will be scrapped, it will continue to publish key economic data.

But it said the NICEI will be reduced from a 19 page report to just five pages.