GOLD prospecting company Conroy posted increased six-month losses of €278,008 (£236,000) in the June-November period despite its drill programme indicating increased samples of valuable minerals in its licensed area.

Net assets slipped back to €17,595,318 (just under £15m) during a half year in which it raised a total of €350,000 in two separate tranches by way of an

unsecured convertible loan note with an existing shareholder.

And the Dublin-based explorer remains upbeat about its future, and believes the recent drilling underlines its belief it has a major gold zone on its acreage.

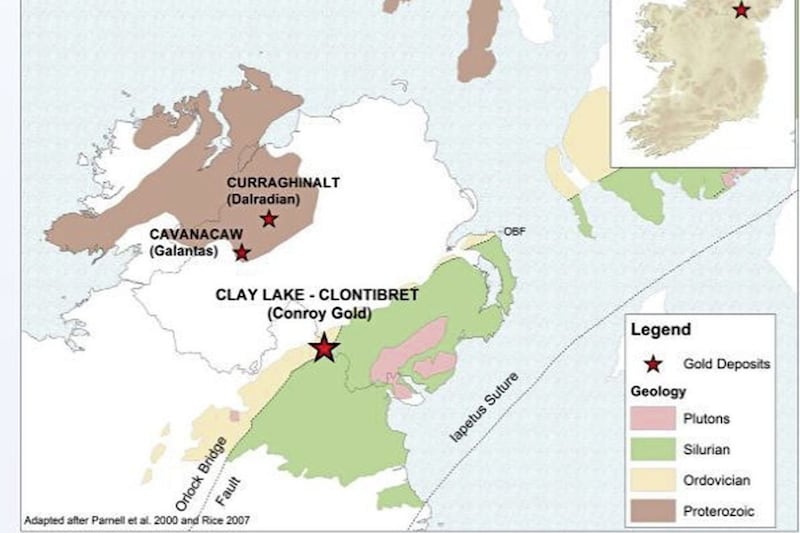

It also comes after it reported the results from rock chip sampling at its Clay Lake gold anomaly in Co Armagh, which indicated the presence of a broad zone of mineralisation and returned the highest gold values it has ever recorded.

Chairman Professor Richard Conroy said yesterday: “The drill programme has confirmed our belief in multi-million-ounce gold exploration targets on the 65 kilometre (40 mile) district scale gold trend we have discovered.

“We intend to actively continue and accelerate our development and exploration programme along the trend including our first gold mine, and to this end we are in talks with a number of potential partners."

Over the period the company, founded in the late 1990s, confirmed new zones containing gold at Slieve Glah in the Longford - Down Massif and between its Clontibret deposit and Corcaskea site.

Conroy Gold has licences to huge swathes of land in Ireland - and also Finland - which it previously claimed has the potential to yield 15 to 20 million ounces of gold, which would make the gold worth billions of pounds and the site one of the largest deposits in Europe.

But while it has poured millions into its sites over the years, carrying out metallurgical testing, sample drilling and digging, and has attracted millions in investment from shareholders, it is yet to actually start mining.