The global economy has been “remarkably resilient” over the past two years but the escalation of conflict in the Middle East risks pushing up food and energy prices across the world, according to the International Monetary Fund (IMF).

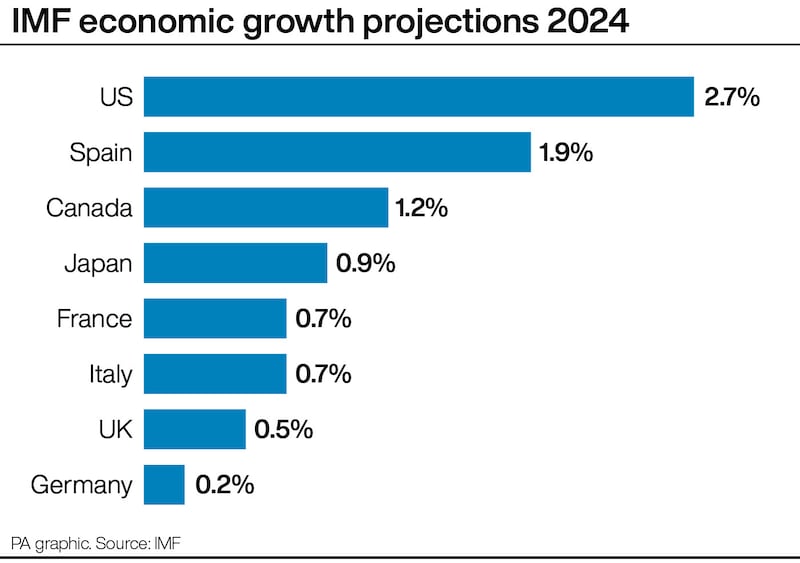

The UK will eke out slower growth this year than previously thought and remain the second-worst performer in the G7 group of advanced economies, new forecasts showed.

The IMF said the global economy has had an “eventful” journey in the years since the Covid-19 pandemic.

Russia’s war in Ukraine triggered a global energy and food crisis, and a surge in inflation, followed by central banks around the world hiking interest rates.

Pierre-Olivier Gourinchas, the IMF’s director of research, said: “Yet, despite many gloomy predictions, the world avoided a recession, the banking system proved largely resilient, and major emerging market economies did not suffer sudden stops.”

Current risks to the global outlook are more or less balanced, meaning there could be both positive and negative surprises that skew forecasts, according to the IMF.

In terms of threats, the economists warned that the Israel-Hamas conflict could escalate further into the Middle East, while continued attacks on ships in the Red Sea and the ongoing war in Ukraine risk new price hikes.

This could see food, energy and transport costs spike around the world, with lower-income countries set to be harder hit.

Providing more detail during a press conference in Washington DC, Mr Gourinchas said the IMF had evaluated the outlook for the economy should oil prices spike by 15% and shipping costs rise.

Under that scenario, there could be 0.7 percentage points added to global inflation, he said.

Higher inflation would, in turn, trigger a response from central banks to further lift interest rates, which would weigh down on activity while also impacting business investment and confidence, Mr Gourinchas cautioned.

But he stressed that the world was not currently in that scenario and that it was too early to say whether recent increases in oil prices would be sustained.

Other risks include a possible slow recovery of China’s troubled property sector, which would have a knock-on effect on global trading partners.

On the other hand, the outlook could be improved as a result of elections happening in many countries this year, which could lead to tax cuts and a short-term boost to economic activity.

In its new assessment of the world economy, the IMF said global output will grow by 3.2% this year, a 0.1 percentage point upgrade from its previous report in January.

It expects UK gross domestic product (GDP) to hit 0.5% this year, a slight downgrade from the 0.6% growth it had forecast in January.

This would make the UK the second weakest performer across the G7 group of advanced economies, behind Germany, which is set to see growth of just 0.2% this year.

The G7 also includes France, Italy, Japan, Canada and the US.

Growth is set to improve to 1.5% in 2025, where the UK’s position will flip to sit among the top three best performers in the G7, according to the finance body’s predictions.

This will be driven by inflation easing and household incomes recovering after a prolonged cost-of-living squeeze.

The IMF predicted that the UK will see Consumer Prices Index (CPI) inflation of 2.5% over 2024, before the rate comes down further to reach the Bank of England’s 2% target over 2025.

The group said the immediate priority for central banks around the world is to “ensure that inflation touches down smoothly, by neither easing policies prematurely, nor delaying too long and causing target undershoots”.

Elsewhere, Mr Gourinchas cautioned that the UK, along with other countries, needed to be rebuilding fiscal buffers so it had the room to support households and businesses should there be another crisis.

He was responding to a question during the press conference about whether it was responsible for the UK Chancellor to have cut taxes in his spring Budget.

A spokesperson for HM Treasury said: “Today’s report shows we are winning the battle against high inflation, with the IMF forecasting that it will fall much faster than previously expected.

“The forecast for growth in the medium term is optimistic, but like all our peers, the UK’s growth in the short term has been impacted by higher interest rates, with Germany, France and Italy all experiencing larger downgrades than the UK.

“With inflation falling, wages rising, and the economy turning a corner, we have been able to lower taxes for 29 million people, as part of our plan to reward work and grow the economy.”