A single victim of investment fraud in Ireland lost approximately one million euro, according to gardai.

The loss happened within the last two years and the person was just one of about 1,000 victims of investment fraud over the previous four years.

Overall, there has been a significant increase in investment fraud in Ireland that has seen 25 million euro stolen from people last year.

Gardai said that 25,360,000 euro was reported stolen in 2023, almost equal to the same amounts stolen in 2021 and 2022 (14 million euro and 11.5 million euro respectively).

In the first two months of this year, more than 55 people have reported investment fraud, double the number of reports in January and February last year.

People are being advised to be alert to criminals posing as investment managers and trying to fool someone into investing money in schemes and projects that do not exist.

Gardai said that sophisticated criminals are taking advantage during the cost-of-living crisis by cloning webpages and targeting victims through online and social media adverts, promising “once-in-a-lifetime opportunities” to instantly invest with fast and large financial returns.

It said more than 965 people have reported incidents of investment fraud to Gardai in the four-year period from January 2020.

On Friday, Detective Superintendent Michael Cryan of the Garda National Economic Crime Bureau said there was a concern the crime was under reported because of embarrassment.

He added: “There is absolutely no doubt this is organised crime.”

Increasingly the victims are male; last year 69% of victims were male and the vast majority of those affected are over 40.

In May 2023 a man in his 40s clicked on a social media link advertising investment opportunities and entered contact details.

He was later contacted by phone from a person purporting to be from a reputable financial institution about purchasing bank bonds, and was defrauded of 100,000 euro.

During 2023, a man in his 60s reported that he had been contacted online about investing with a British financial institution and then had 300,000 euro stolen after transferring funds.

Gardai said that in January 2024, a man in his 70s based in the east of Ireland reported that he had more than 190,000 euro stolen after he invested the money in what he thought was a legitimate British company.

Earlier this year, a man in his 50s had 121,000 euro stolen through investment fraud.

The victim understood that he was legitimately engaged in online trading and was communicating with someone online who had encouraged him into it.

Gardai said this was “a particularly sophisticated crime” as the victim had access to an online trading app and believed that he could see his funds being traded – but the app itself was fake.

They urged people not to respond to pop-up or social media ads or messages with claims about investment returns and to ignore unsolicited cold calls about investments.

They also asked people not to invest until they get reliable financial and legal advice and to check the regulatory status of companies via the Central Bank of Ireland website.

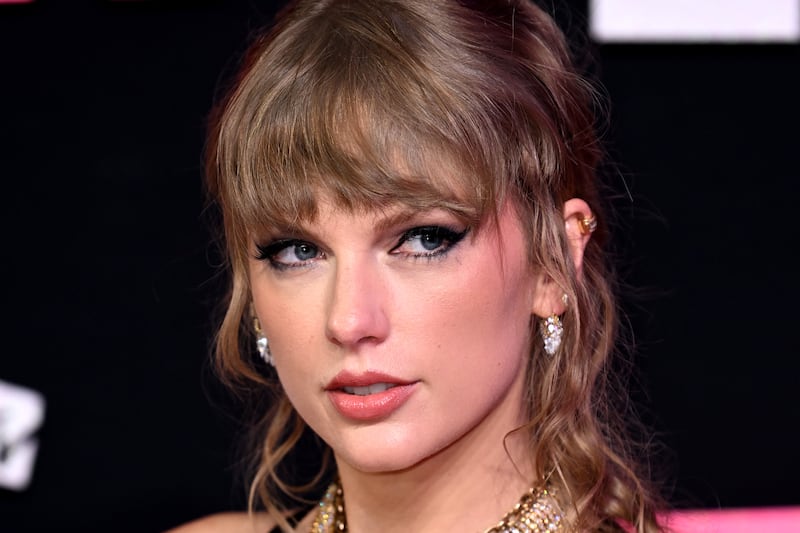

Some of the advertisements use fake and manipulated testimonials from celebrities to encourage people to follow through with the fraud investments.

For example, people have reported manipulated adverts featuring Tanaiste Micheal Martin and former RTE news anchor Anne Doyle.

Recently, the ads can even be videos edited with lip movements synced to dubbed audio.

Speaking at a briefing at the GNECB headquarters in Blanchardstown, Mr Cryan said the money taken through the frauds is hard to track as it very quickly leaves the jurisdiction.

Asked where the fraudsters are operating from, he said this was also hard to determine but there was “no doubt” that some of the organised criminals were in Ireland.

He added: “A lot of the victims will talk about people with very well-spoken British accents. That is a common denominator across a lot of the investment frauds.”

The fraud investigator said the bad actors, who often follow scripts, appear to “know what they’re talking about” on investments and cryptocurrencies.

Mr Cryan said: “People are always going to be attracted to the promise of big profits.

“That is why these sophisticated, fraudulent investments are on the rise.

“Those affected by this type of crime are ordinary people who really unfortunately can lose their life savings, nest eggs or a retirement lump sum.

“Investment fraud can quite easily happen, the fraudster will sound convincing and claim to have insider knowledge, but they are following a well-rehearsed script, they’re prepared for potential questions and they tend to be excellent actors.

“They may purport to be working with a reputable firm and may even quote authorisation numbers or give the real address of a legitimate firm, but this is all a (ploy).

“I strongly encourage anyone who has been a victim in the past or who has more recently become a victim of investment fraud to please come forward and speak with us in any Garda station.”