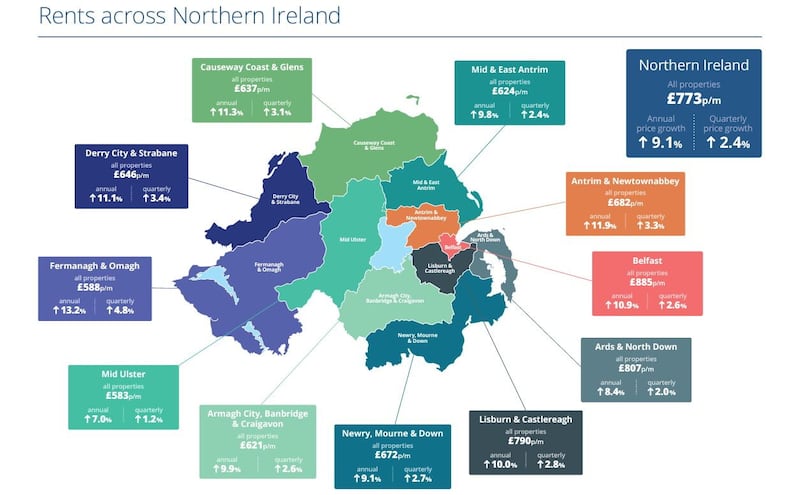

THE cost of renting a house in Northern Ireland has increased by 10 per cent in 12 months, new research from PropertyPal shows.

The average rent for a residential property stood at £773 per month in the first quarter (Q1) of 2023.

That was 2.4 per cent up on the fourth quarter of 2022 and 9.1 per cent higher over the year.

Rent is rising faster than property prices, which climbed by 8.1 per cent over the same 12 month period.

The listing website said the combination of “exceptional demand against the enduring backdrop of restricted supply” is continuing to drive up rent prices in the north.

House rent inflation was even higher, rising by 2.5 per cent in one quarter to £775, leaving it 9.9 per cent up over the year.

The average four-bed house now attracts a rent of £1,060, up 2.9 per cent since the end of 2022 and 10.7 per cent higher than 12 months ago.

The average apartment in Northern Ireland was renting for £768 per month in Q1 2023 - 7.7 per cent up year-on-year. The rent for an average one-bed flat was £628, with two-beds attracting £761 and three or more bedroom apartments going for £1,012 on average.

PropertyPal said the average rental listing is attracting between 55 and 60 enquires from prospective tenants.

Prior to the Covid-19 pandemic, the average rental property attracted 15-20 enquiries.

On average, PropertyPal said it took 29 days for a rental property to reach ‘let agreed’ in Q1.

The listing company’s chief operating officer, Jordan Buchanan, said there were 45 per cent fewer rental properties advertised on the website in Q1 2023 compared to 2019 levels.

“However, enquiries sent to estate agents for available properties have reached multi-year highs.

“This imbalance has created compounding pressures, as reflected in strong rates of rental price inflation.

“While a cooling inflationary environment may lead to a deceleration in the rate of rental inflation, the persistent structural imbalance suggests that a significant slowdown is unlikely in the near future.

“Consequently, tenants may need to allocate a larger portion of their income towards paying their rent.”

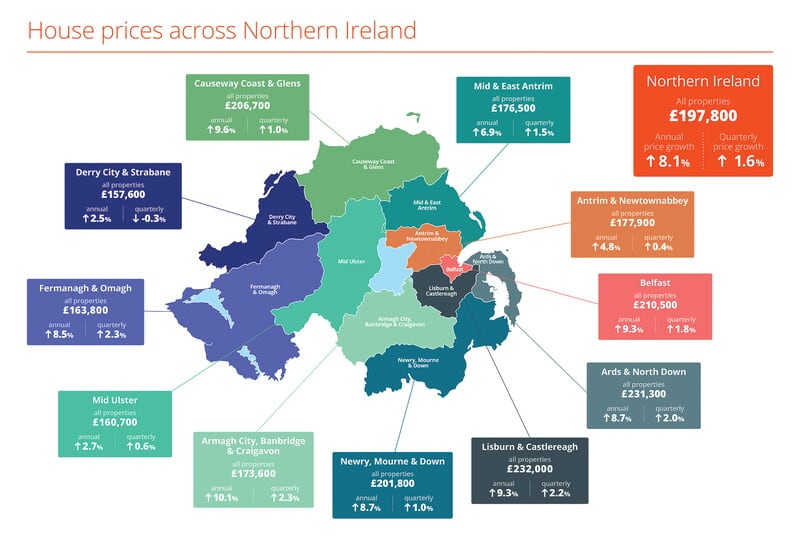

Meanwhile, PropertyPal said activity in the housing market returned to pre-covid levels during the first quarter of the year.

The average property sold for £197,800 in Q1 2023, up 8.1 per cent on last year, with houses averaging £203,700 (+8.5 per cent) and apartments £141,200 (+2.6 per cent).

The price of apartments actually fell by 0.5 per cent between Q4 2022 and Q1 2023.

New build houses also dipped 0.5 per cent over the quarter.

Mr Buchanan said: “January and February 2023 saw cautious market activity, likely due to residual effects from the economic turbulence of late 2022.

“However, economic stabilisation and an improved outlook has led to a significant increase in home sales in March, surpassing pre-Covid-19 averages by 4 per cent and resulting in properties transacting one week faster than usual.

“Accurately valued properties continue to attract the most interest, with average listed prices growing by 1.6 per cent over the past three months and an 8.1 per cent increase over the past 12 months.

“As broader inflationary pressures are expected to ease, house price inflation is likely to decelerate. “The potential 0.25 per cent base rate increase by the Bank of England on May 11 2023 is already factored in by lenders, and a more stable lending environment has led to increased competition for business.”