HOUSE prices continued to rise in the north between the first and second quarters of 2023, new research from Ulster University suggests.

Despite higher interest rates pushing up the cost of borrowing, the university’s latest house price index found the average price of a home here rose by 0.7 per cent to £204,311.

But the same report showed some signs of decline in the second quarter of the year, with buyer demand weakening.

Ulster University said potential buyers and sellers in Northern Ireland appear to be adopting a cautious approach, playing a ‘holding game’ in response to the dynamic and ever-changing borrowing landscape.

The index, which is produced with the north’s Housing Executive and the Progressive Building Society, uses a different methodology from the official government endorsed Northern Ireland House Price Index, which put the average house price in the north at £172,005 in the first quarter of 2023.

Land & Property Services and the Northern Ireland Statistics and Research Agency (Nisra) are due to publish their second quarter research on Wednesday.

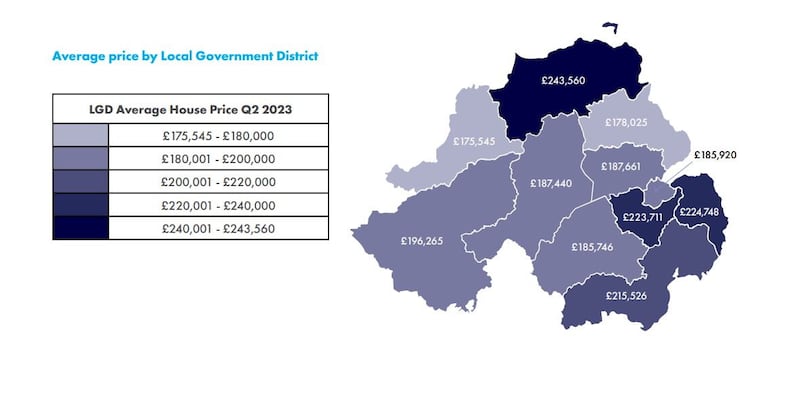

Ulster University’s latest study shows a varying picture for different parts of the north’s housing market.

Read more:

- Just like the weather, business conditions in Northern Ireland take a turn for the worse

- Average property price in Northern Ireland up to £200,600 as rents creep towards £800 a month

- Richard Ramsay: What's the biggest question in the local housing market?

Prices for terrace and townhouses rose by 2.9 per cent to £135,682 between the first and second quarters of the year, while the value of detached homes increased by 1.6 per cent to £290,340.

Apartment prices largely held at around £159,000.

But, the average paid for a semi-detached house dropped by almost 1 per cent to £189,000.

Ulster University’s lead researcher, Dr Michael McCord, said the research pointed to more cooling in the housing market.

He said the increasing signs of waning buyer demand and increased mortgage borrowing costs, against the backdrop of a potential recession, means the market will likely continue to slow down in the second half of the year.

But he said the demand for housing and shortage of available stock, means potential buyers shouldn’t expect any major drop in prices.

“The effect this will have on house prices remains to be seen, but any price correction is likely to be moderate with demand-supply imbalance continuing to be a factor in prices remaining stagnant,” said the academic.

Head of research at the Housing Executive, Ursula McAnulty, said: “As affordability pressures continue to take hold, purchaser confidence is showing signs of waning, with potential buyers and sellers playing a ‘waiting game’ in light of the current economic uncertainty.”

The Ulster University report comes as Ulster Bank’s latest research pointed to a slowdown in the north’s private sector last month.

July’s purchasing managers’ index showed business conditions in decline for the first time in six months.