A CO Down couple who invested nearly £50,000 in an unbuilt Caribbean holiday home have cleared the first stage in a court battle for compensation.

Kilkeel-based fisherman Paul McCullagh and his wife Mary were granted leave to seek a judicial review amid claims they received negligent financial advice.

Ruling that they have established an arguable case, a High Court judge said the episode ended in "catastrophic results" for them.

The couple claim they were persuaded to re-mortgage and buy property abroad after going to see a financial adviser in 2008.

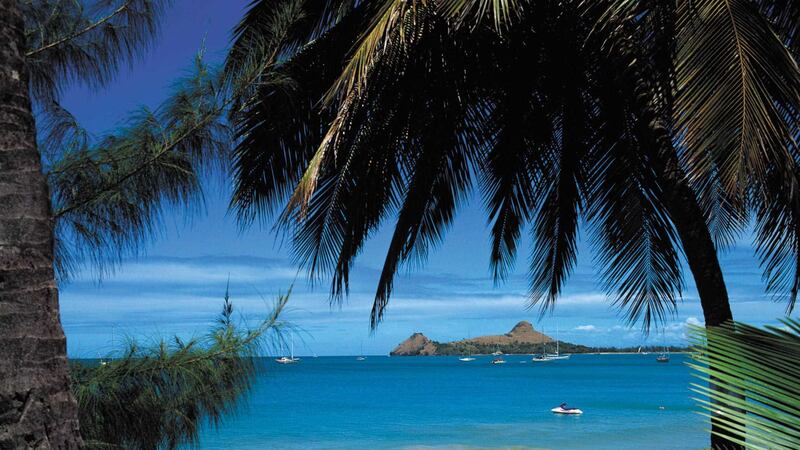

They spent £46,500 on a development in St Lucia which was never built and is said to have no current value.

A lawyer for the McCullaghs insisted it had not been their plan to seek foreign property.

Alistair Fletcher told the court on Friday: "They were going in to get mortgage advice and coming out with financial advice."

Legal action was launched after the Financial Services Compensation Scheme (FSCS) turned down their bid for repayment last year.

The statutory body decided their case involved investment advice not covered by its fund.

But Mr Fletcher argued that it was linked to recommendations on his clients' mortgage situation.

The court heard claims they were told the investment was a "no-brainer".

According to Mr Fletcher it was the financial adviser pushing the couple to put money into the Caribbean development.

David Scoffield QC, for the FSCS, contended that the couple have failed to show they received negligent advice on the mortgage product taken out.

"It's plain that even if the property deal didn't work out, they were able to afford the mortgage, and it was suitable for them bearing in mind they wanted to raise funds for a property investment," he said.

Pointing to the McCullaghs' continued ability to make their repayments, Mr Scoffield also claimed there was no public interest in legal challenge continuing.

Despite acknowledging the strength of those submissions, Mr Justice Maguire held there was sufficient merit to allow the action to proceed.

He said: "The story in this case is a fairly lamentable one.

"The use by the applicants of this financial adviser's office, whatever precipitated it, has turned out to have catastrophic results for them."

The judge added: "Unfortunately, it proves that the financial adviser is a man of straw, and therefore resort has had to be made to seeing compensation under the FSCS."

Granting leave to apply for a judicial review, he listed the case for review in March.