Online Government services have begun accepting mobile payments using methods such as Apple Pay, meaning transactions can be approved with fingerprints or facial recognition.

The gov.uk website is accepting transactions using Apple Pay and Google Pay for four services initially, but it will be rolled out more widely and to local government, police and the NHS later this year.

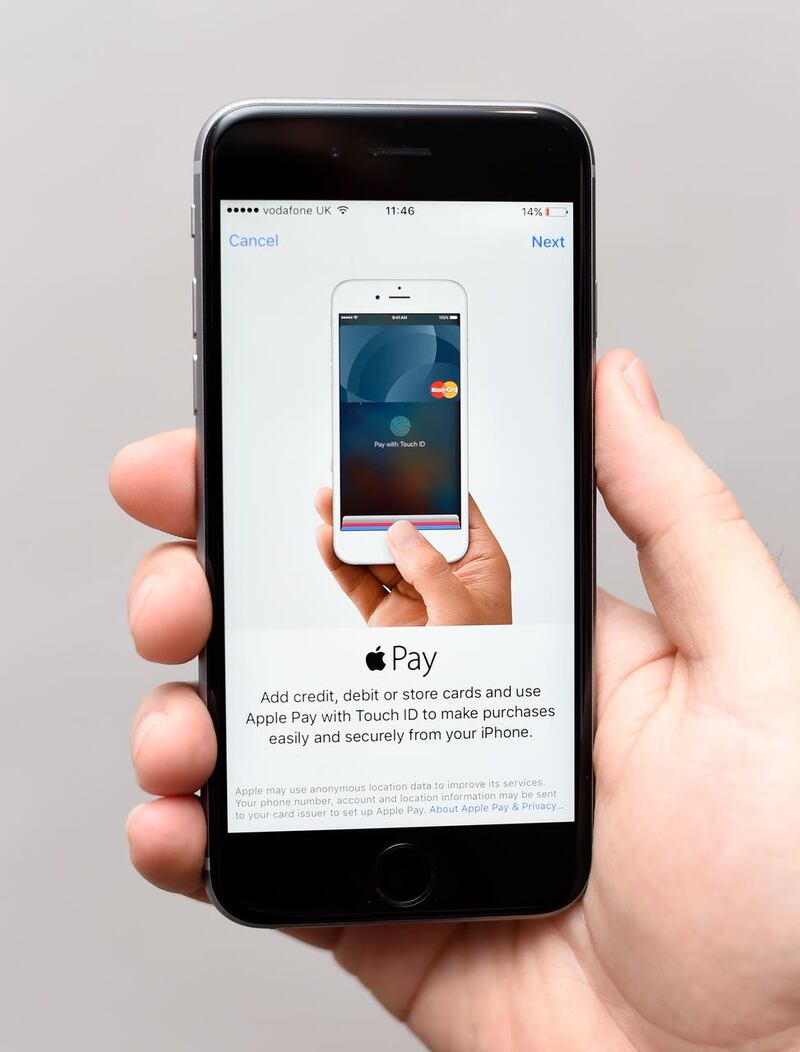

Mobile payments arrived in the UK with Apple Pay in 2015 and enable users to securely store bank details on their devices and pay instantly, without having to enter cards details each time. It can also be used on some websites.

Payments for the Global Entry Service – which enables UK citizens to get expedited entry to the US – as well as basic online disclosure and barring service (DBS) checks, the Registered Traveller Service and the Electronic Visa Waiver Service for people in the Middle East coming to the UK, can now be made via Apple or Google Pay.

Till Wirth, lead product manager of gov.uk Pay, said: “Allowing people to pay for Government services through Apple Pay and Google Pay means they won’t have to enter their credit or debit card information when making payments.

“This innovation will increase the convenience and security of gov.uk Pay for users and hopefully make their experience online a lot easier.”

The website launched its online Pay platform in 2016 and has since been used to make more than 2.9 million transactions using credit and debit cards.

Oliver Dowden, the minister for implementation said: “We’re focused on making access to Government services as easy as possible. And introducing mobile payment to gov.uk Pay will also make transactions more secure.

“This is another example of how we are working smarter as a Government – improving services for people as well as reducing fraud and costs.”