Derry Girls, Channel 4, Tuesday

Oh dear, this is a bit awkward.

Derry Girls has returned for its triumphant third and final series.

A comedy show Ireland and the UK has taken to its heart and which has promoted the city of Derry like almost nothing before it.

Writer Lisa McGee and the actors are among the best-known faces in Ireland, adorn a gable wall in their native city and recently got referenced in The Simpsons.

Yet … the opening episode rather missed the mark.

The storyline was the girls attempting to recreate the Oscar success of some East German teenagers by making a short film about the Troubles and the peace process.

But significantly more important matters intervene – the GCSE results are due.

As ever terrified of failure, Clare fears the end of everything should the results be poor.

“We’re girls. We’re poor. We’re from Northern Ireland and we’re Catholic for Christ’s sake.”

They hatch a plan to break into the school to get the score cards the night before they are handed out and get ahead of the problem.

Obviously, it’s going to go wrong but does so spectacularly when they encounter two burglars and mistaking them for school employees, help the pair to load their van with expensive computer equipment.

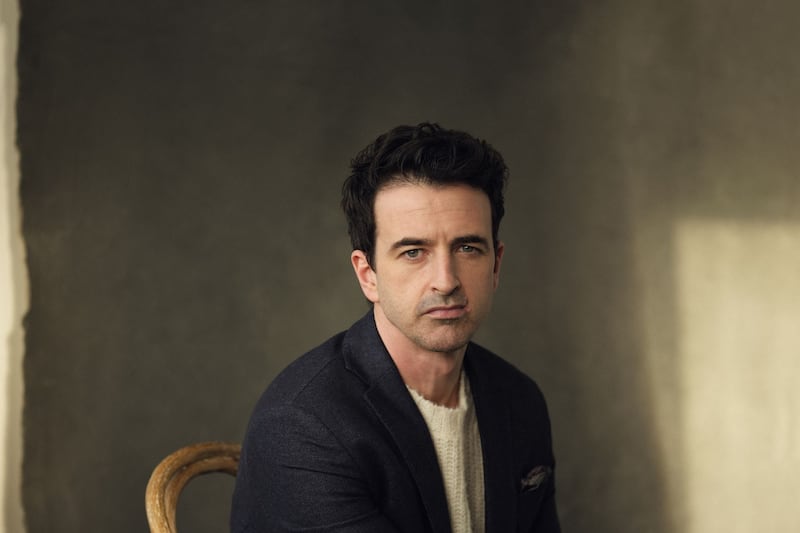

As the real thieves make their escape, the RUC swoop and our heroes end up in “Londonderry” barracks being questioned by Liam Neeson.

Sub plots include Grandad Joe covering for his feral cat who likes to kill all around him, including the neighbour’s pet rabbit.

Joe, an ardent republican, gets Gerry to help him bury the body in a remote area in the middle of the night.

It was reminiscent of the final outings of Only Fools and Horses.

Those, at the time much-anticipated, Christmas specials are never in the now common highlight shows because they had lost the edge that made the series great.

These are small margins, but there is a qualitative difference between the scenes which got Derry Girls noticed (the weeping Virgin Mary for instance) and the GCSE theft plot of this week.

Still, plenty time for a return to form in the rest of the series.

****

Panorama, BBC 1 and Dispatches, Channel 4, both Monday

Panorama and Dispatches gave us the full despair of the cost of living crisis this week.

There are important and significant issues, with Dispatches focusing on the most dramatic increase in the price of fuel since the 1970s and Panorama giving us real people examples of the choice to heat or eat.

There is much negativity to focus on and I do not blame the two current affairs shows for that, but while it is difficult for many there is a silver lining in the cloud for some.

With inflation hitting 7 per cent this week and wages and benefits failing to keep pace, almost everyone is taking a hit on the spending side.

However, if you are in debt and have planned correctly, inflation can be your friend rather than an enemy.

Many families who are facing the ‘heat or eat’ choice do not have mortgages but for those who do, that inflation is eating into the biggest loan you will ever have.

Consider that many will have fixed rate mortgage deals of 3 per cent or less (the most competitive deals at the moment will charge you less than 1.5 per cent interest) while the value of your loan is declining at 7 per cent per annum. That’s a negative interest rate of 4 per cent for many people.

Or another way to look at it - should the rate of inflation stay constant at 7 per cent over the next ten years, then the value of your loan relative to real prices will have halved in a decade.