LONDON-listed Russian stocks have slumped as companies suffered from delayed investor reaction to the launch of US sanctions against Moscow on Friday.

The FTSE 100 ended the day up 0.15 per cent or 11.11 points at 7,194.75, but was dragged down by Russian mining company Evraz, which held the bottom spot on the blue chip index after falling 65.1p to 385.4p.

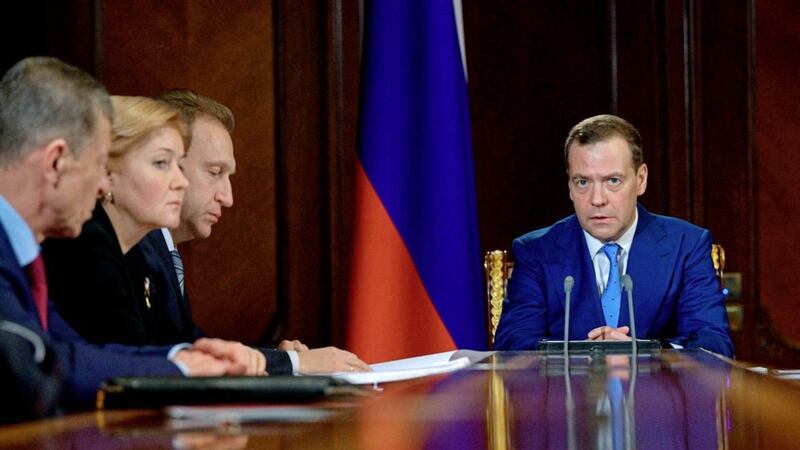

It follow's Friday's launch of US sanctions on a raft of high-profile Russian business people and their companies as well as senior officials over what the US Treasury called a "range of malign activity around the globe", including continued occupation of Crimea and the supply of weaponry to the Assad regime in Syria.

The US also cited "malicious cyber activities" and attempts to "subvert western democracies".

David Madden, market analyst at CMC Markets UK, said: "Evraz shares have tumbled after the US imposed sanctions on Russian tycoons.

"Relations between the US and Russia have deteriorated over the situation in Syria.

"The steel maker has large exposure to Russia, and the stock also came under pressure during the Russia/Ukraine conflict in 2014."

He noted that BP was also feeling the pinch on account of its exposure to Russia through its stake in Rosneft, with the oil giant among the worst performers on the FTSE 100, down 4.85p at 493.55p.

Away from the blue chip index, shares in energy firm EN+ fell 41 per cent or 4.05p to 5.6p, while Polymetal tumbled 18 per cent or 133p to 591p.

Across Europe, the French Cac 40 and German Dax rose 0.1 per cent and 0.17 cent respectively.

In currency markets, sterling was on the rise, up 0.3 per cent against the US dollar at 1.413 and up 0.3 per cent versus the euro at 1.147, thanks in part to solid UK house price data.

Mr Madden said: "The Halifax UK house price survey showed an increase in March of 1.5 per cent on a month-on-month basis, and economists were forecasting a reading of 0.2 per cent.

"It was the fastest growth rate in over a year."

Brent crude jumped 2.3 per cent to around US$68.58 per barrel as geopolitical concerns in Syria supported commodity prices.

In UK stocks, Rolls-Royce Holdings rose 10.8p to 878.8p as the engine maker said it was offloading fuel injection technology firm L'Orange to America's Woodward in a £610 million deal.

The sale of L'Orange – a subsidiary of Rolls-Royce Power Systems – has been backed by the boards of both companies and is expected to be sealed by the end of the second quarter of 2018.

French Connection surged 6p to 49p amid a £23.3 million deal to sell lifestyle brand Toast to Denmark's Bestseller. Toast, the women's fashion and homeware retailer, has 12 stores and a wholesale deal to sell products through department store chain John Lewis.

Shares in Rathbone Brothers rose 40p to 2,414p after the wealth manager confirmed it was in takeover talks with Glasgow-based investment manager Speirs and Jeffrey over a potential £200m deal – though no binding offer has been made.

The biggest risers on the FTSE 100 were Associated British Foods up 77p at 2,572p, WPP up 26p at 1,188.5p, Micro Focus International up 22.5p at 1,151p, and International Consolidated Airlines Group up 9.2p at 624.8p.

The biggest fallers were Evraz down 65.1p at 385.4p, Glencore down 12p at 339.15p, Fresnillo down 20.5p at 1,221.5p, and Smurfit Kappa Group down 46p at 3,012p.