MOVEMENT on restrictions for creditors pursuing winding up petitions against companies in the north is expected in the coming months, insolvency experts have said.

Protections for businesses were established in the wake of the Covid-19 pandemic to give firms in financial distress breathing space to explore rescue and restructuring options free from creditor action.

The temporary procedural rules lapsed at the end of March 2022 before permanent rules could be approved and introduced by the now defunct Executive.

That prompted the Bankruptcy Master in Northern Ireland to issue guidance, which effectively stalled creditor bankruptcy petitions for another 12 months.

But the introduction of the Insolvency (Amendment) Rules (Northern Ireland) from today (Monday) is expected to be followed by new guidance permitting creditors to lodge winding up petitions in the High Court, meaning many more companies being open to pursual from creditors.

Insolvency practitioner Darren Bowman, from Belfast firm Baker Tilly Mooney Moore, said insolvency practitioners, directors and creditors are braced for movement in the coming months.

“This moratorium procedure has been necessary since the onset of the Covid-19 pandemic and throughout these recovery years as companies faced a drop in revenue and consumer confidence, administered the furlough scheme, and eventually navigated the withdrawal of government support measures,” he said.

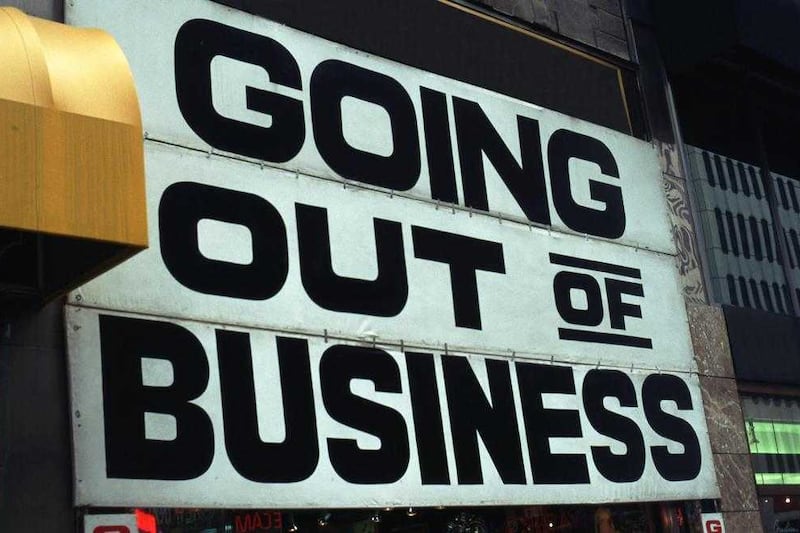

“We know the various measures put in place by Government to protect businesses during the Covid pandemic will have created a number of ‘zombie’ companies across Northern Ireland which are companies that essentially would not have survived under normal economic conditions.

“Now, we are likely to see more businesses being pursued by creditors.

“Though a number of rescue and recovery options exist before the insolvency route, this recent move should come as a warning to businesses in financial distress and their advisors to seek expert advice urgently.”