DANSKE Bank's just-published quarterly sectoral forecast report sets out expectations for the Northern Ireland economy in 2022 and 2023, and it says the local economy is estimated to have grown in the first quarter of this year.

But the pace of growth from quarter two onwards is likely to be slower as household incomes are increasingly squeezed by the high rate of inflation. These inflationary pressures are likely to weigh on growth throughout the remainder of 2022 and into 2023.

We are forecasting that the Northern Ireland economy will grow by around 3.6 per cent this year but expect the pace of growth to slow to about 1.0 per cent next year.

When compared with historical economic growth rates, our 2022 projection would appear to be relatively strong. However, it’s important to note that this forecast still reflects an element of the recovery from the coronavirus pandemic.

Hence, at a sector level, the parts of the economy expected to experience the fastest rates of growth in 2022 are the accommodation and food services sector and the arts, entertainment and recreation sector – two industries that were particularly adversely impacted by the pandemic.

But as we move forward into the rest of 2022 and into 2023, what are the main factors that could influence the economy? What are the prospects for the labour market? And what are the key risks and uncertainties around the economic outlook?

Here are five things you need to know from our latest report.

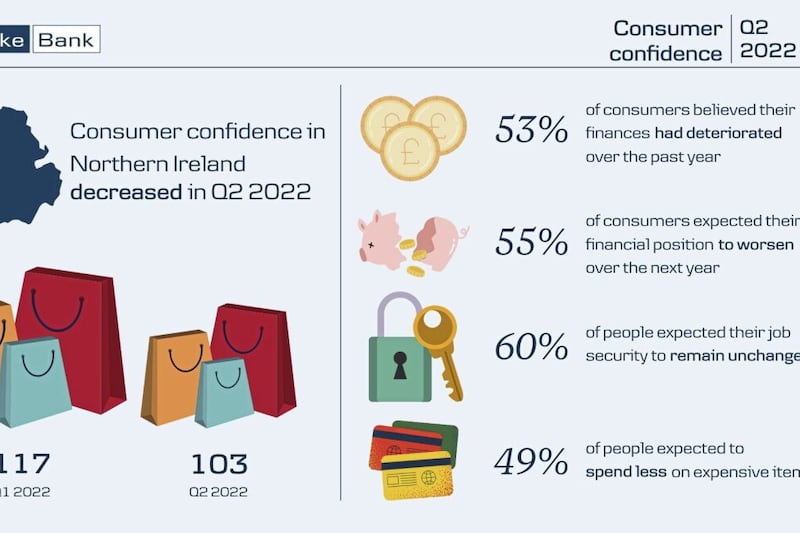

- Inflation is squeezing consumer spending - Inflation in the UK hit a multi-decade high of 9 per cent in April 2022, up from 7 per cent in March and 5.5 per cent in January. We expect the rate of price rises to move even higher and are now forecasting that inflation will average around 8.5 per cent in 2022 and about 4.5 per cent in 2023. This high inflation is putting significant pressure on people’s real incomes and it is likely that consumer spending will be squeezed throughout the remainder of this year and into next year.

- The fiscal policy environment is changing - The changes come as the government has unwound the support it provided during the coronavirus pandemic and a number of policies have been introduced to attempt to strengthen the public finances. However, some measures have also been announced to support people with the high cost of living.

- Further base rate rises are expected this year - In response to the high inflation, the Bank of England’s Monetary Policy Committee (MPC) has increased bank rate at each of its last four policy meetings and it now stands at 1 per cent. A large part of the recent rise in inflation has been due to higher fuel and energy prices and global supply chain disruption, factors which monetary policy can’t directly control.

Higher prices – particularly for necessities such as food, fuel and energy – may weigh on consumers’ discretionary spending and could contribute towards a slowdown in price rises and economic activity levels even without further base rate rises. Given these factors, monetary policy decisions are quite complicated at present but we expect the MPC to increase bank rate twice more in 2022, and it is expected to be 1.5 per cent at the end of this year.

- The local labour market is performing strongly - The unemployment rate fell in the first quarter of the year to just 2.3 per cent and the number of payrolled employees increased by 0.4 per cent over the month in April. We expect the labour market to continue to perform well and are forecasting that the annual average number of employee jobs will increase by around 1.2 per cent in 2022, followed by a further rise of about 0.6 per cent in 2023. We are also projecting that the unemployment rate in Northern Ireland will average around 2.7 per cent in 2022 and 3.3 per cent in 2023.

- The risks and uncertainties around the economic outlook are particularly elevated - There are a number of risks and uncertainties that have the potential to impact the performance of the economy. If inflation were to rise higher than forecast or stay at elevated rates for longer, it could weigh even more heavily on economic growth. Prolonged supply chain disruption could also exacerbate inflationary pressures and pose challenges for goods-based businesses. Political uncertainty, including around the implementation of the post-Brexit trading arrangements, remains elevated in Northern Ireland. And if the war in Ukraine were to be particularly prolonged, the human consequences would be tragic and the economy could also be negatively affected.

In summary, there is much uncertainty around the outlook. We expect the Northern Ireland economy to grow this year and next year but, given the high rate of inflation, the changes to the economic policy environment and the elevated uncertainty, the rate of growth is likely to slow.

Conor Lambe is chief economist at Danske Bank