THERE is a Chinese proverb that you should wish to live in interesting times. There are few people who would disagree that the last 18 months have been “interesting”. Having come through the experience of a once in a lifetime pandemic, with the benefit of hindsight, you would be forgiven for living by the more cautious adage, “be careful what you wish for”.

China remains a focus for interest, debate and commentary, particularly when it comes to observing its economic rise over recent decades. From the Belt-and-Road initiative to the move to technological excellence, China has enthralled and intrigued Western commentators in equal measure.

In 1990, China was the eighth largest economy in the world, with GDP per capita in the hundreds of dollars and a non-existent middle class. Farming and metal bashing were core activities and only a quarter of the population lived in cities.

Today China is close to the world’s largest economy and its middle class now accounts for around 40 per cent of the population: a meteoric turnaround in just three decades.

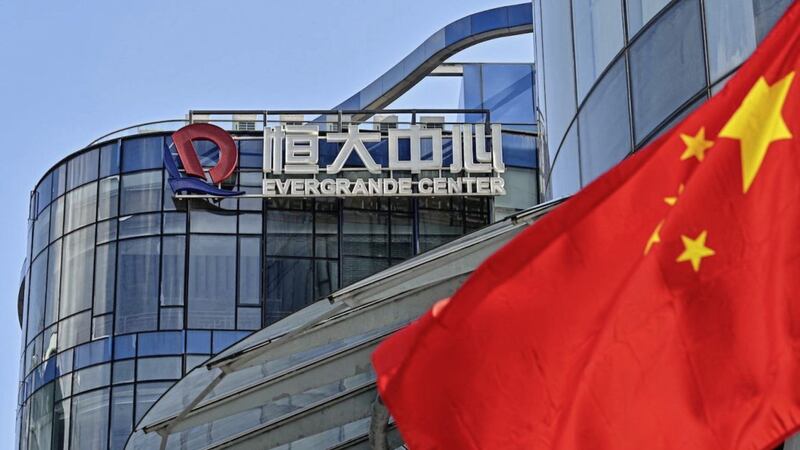

The advancement of its property market too has prompted many global headlines. However, for the last few weeks, Evergrande, one of China’s most prominent real estate companies, has been in the headlines with worrying reports of default.

Evergrande’s exposures are large, complex, and still to be fully understood, but what is key is the scale of borrowing involved: one commentator described it as one of the world’s “most indebted real estate developers”.

Regular readers of this column may wonder about the relevance of this to local investors. As ever, we must take a global view of markets and economic influences; recent financial press is full of articles about whether the default of the politically connected Evergrande, is going to be China’s Lehman Brothers moment?

If you’ve been interested in finance or invested for any length of time, the name of Lehman will be firmly etched in your mind. Many of us will never forget the fall of Lehman Brothers – a hitherto star name in finance with intricate and far-reaching ties across the banking and investment world.

Back in 2008, the words “Lehman” and “crash” or “crisis” were rarely seen apart, and its collapse had impact around the world, with repercussions lasting years.

Turning back to Evergrande however, few outside of the relevant circles will have heard about the company which, although vast and multi-connected in many ways, still operates largely in China, within a closed financing system.

Many have been flagging that Evergrande was considered “junk status” on the bond market, those investments deemed to be less creditworthy than their ‘investment grade’ peers, with yields reflecting the relevant perceived level of risk.

Of course the insolvency of a single company in one sector is unlikely to have as far-reaching ramifications as a company with connections across every facet of banking and finance (and by extension multiple and various industries) in the way we saw with Lehman.

What the Evergrande example does illustrate is that, for the average investor, diversification is key. Any strategy that seeks to solely rely on one country, sector, market or company is more likely to be at the mercy of any default and any particular local or sectoral issue which crops up.

There are many commentators predicting that the next one hundred years will be China’s century, marking it out as presenting plenty of investment opportunity. Evergrande may signal an important warning flag in the region and the ripple effects from its potential collapse would be, to go back to the start of this column, “interesting”.

As ever for the investor, what is likely to be of more benefit is to have a long term but diversified view and act accordingly. We’ll be watching this one closely.

:: Jonathan Sloan is head of Barclays Wealth & Investment Management in Belfast