GUINNESS owner Diageo has restarted its plan to return up to £4.5 billion of cash to investors as it continues to bounce back from the pandemic.

The group, which also makes Johnnie Walker, Smirnoff and Baileys, said it now expects full-year earnings growth of at least 14 per cent as sales have staged a further recovery since its first half.

Diageo said that, thanks to the strong performance, it will resume the plan to return cash to shareholders that was paused in April last year due to the coronavirus crisis.

It will launch the second phase of the programme with £1 billion of payments by the end of 2021-22, starting with £500 million in share buybacks due by mid-November.

The move comes as part of a wider long-term aim, initially launched in 2019, to return up to £4.5 billion to investors, but the timescale has been extended by two years to June 30 2024.

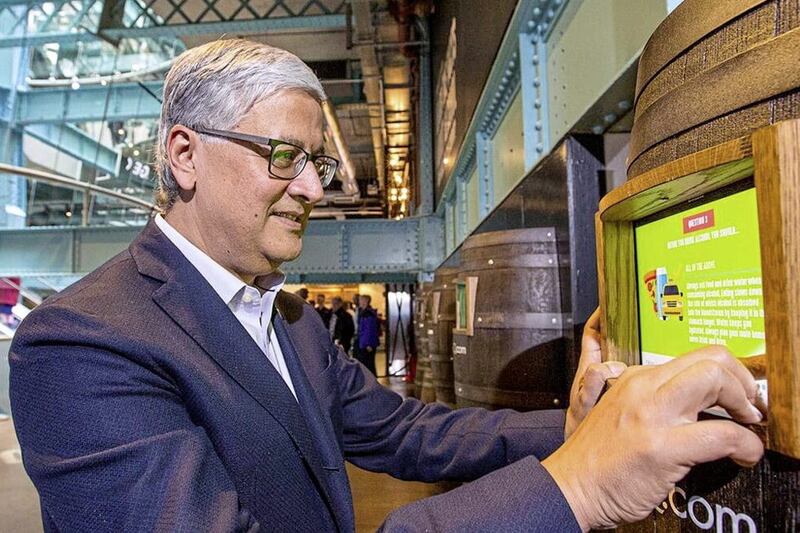

Chief executive Ivan Menezes said he is "very pleased with how our business is recovering".

He added: "When we have excess cash, we have been clear that we will seek to return it to shareholders."

The group revealed that trading has been "particularly strong" in North America - its largest market.

Europe has seen solid off-licence sales and a boost from hospitality beginning to reopen as lockdowns lift in some countries, such as the UK.

But its significant travel division remains under pressure due to the ongoing restriction on air travel.

Diageo's half-year results show that pre-tax profits fell 8.3 per cent to £2.2 billion in the six months to the end of 2020, with net sales down 4.5 per cent at £6.9 billion.

Sales in Diageo's Travel Retail Europe division dropped 72 per cent during the period, while pub, cafe and restaurant closures hit on-trade business.

However, the group returned to so-called organic net sales growth in the first half.

On the move to restart the capital return programme, Hargreaves Lansdown equity analyst William Ryder said: "On the one hand, this is good news for investors, because further share buybacks will mean each remaining shareholder owns a slightly larger slice of the pie.

"But on the other, there's a reasonable case for keeping buybacks on ice a little longer - debt is still higher than ideal."