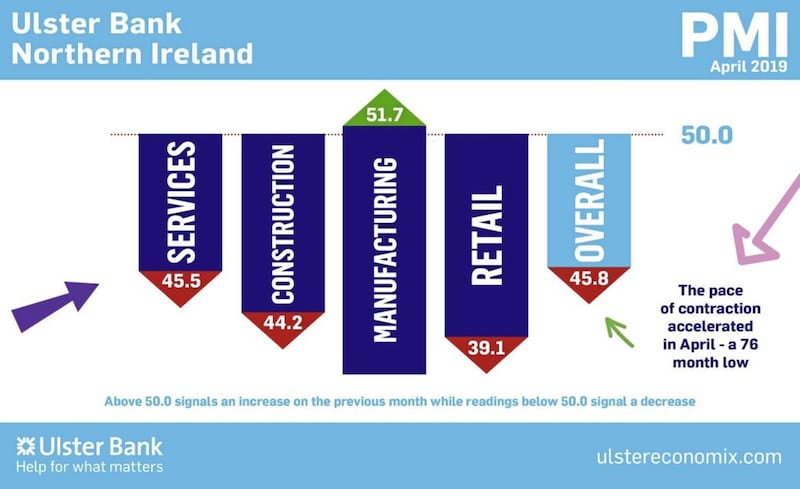

THE north's private sector has reported its sharpest fall in business activity for almost seven years, according to the latest PMI data.

The Ulster Bank report for April shows that activity, new orders and employment all reported contractions not seen since the end of 2012, with Brexit and the lack of a local government cited as key factors.

The slump in activity contrasted with a rise across the UK as a whole.

A decline in new orders resulted in a further fall in outstanding business in April. Due to a fall in workloads, employment levels also decreased for the fourth month running, according to the report.

Manufacturing remained the only sector to record an increase in output, while renewed weakness was evident within retail, construction and services. In relation to the latter it posted the weakest month since January 2013, while retail sales were the lowest in almost seven years.

Despite continued sharp input cost inflation, companies only raised selling prices at a modest pace, primarily due to weakening customer demand.

Ulster Bank chief economist, Richard Ramsey believes the latest data is a cause for concern.

“April saw an improvement in business conditions across most of the UK regions. However, Northern Ireland was a notable exception to this trend. Indeed, rather than improving, the pace of contraction across a range of indicators accelerated," he said.

"Private sector output, orders and employment posted their fastest rates of decline since the final quarter of 2012. As a result, Northern Ireland found itself at the bottom of the UK regional rankings for these measures. Brexit and the lack of a Stormont Executive continue to be cited as factors impacting negatively on local business. Looking ahead, there is no quick-fix for these issues."

“Overall, aspects of Northern Ireland’s private sector growth were flattered by the levels of stockpiling taking place in the run up to the anticipated Brexit date. Similarly, as stockpiling has eased off, this is perhaps having the opposite effect. April’s PMI data is particularly downbeat relative to recent years but, outside of retail, it would be premature to read too much into it at this stage," Mr Ramsey added.