THE Northern Ireland economy continues to face a number of headwinds.

The Executive and Assembly have been absent for almost two years. Prices are still rising faster than the Bank of England’s target rate. And Brexit is getting closer and closer. The latest Danske Bank Northern Ireland Consumer Confidence Index revealed that in the third quarter of this year, these were the big issues causing concern to local people.

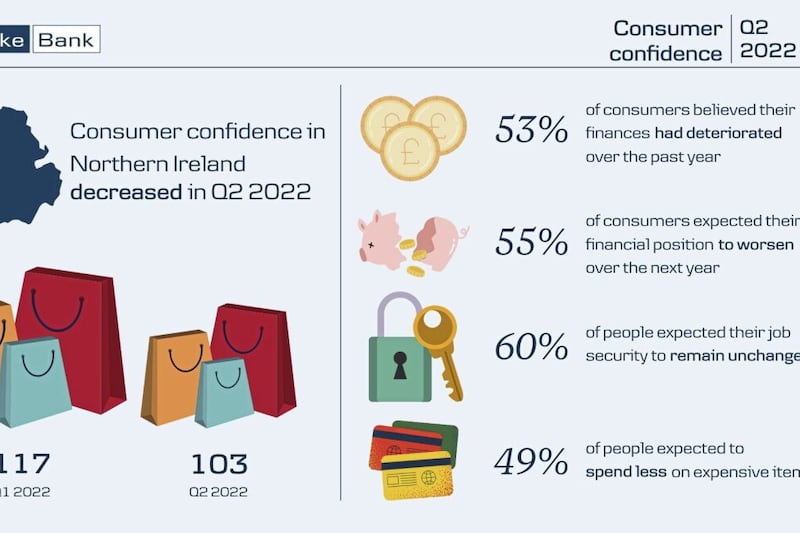

Consumer confidence indices are produced in countries all over the world and they give an estimate of how optimistic, or pessimistic, people are feeling. In advanced economies, like Northern Ireland and the wider UK, consumer spending typically makes up the majority of GDP. When consumer confidence is high, you would normally expect to see consumer spending in the economy growing relatively quickly. And this can often contribute to healthy rates of overall economic growth.

Our recent study covered the third quarter of this year and showed that consumer confidence in Northern Ireland fell for the second quarter in succession, with confidence levels hitting their lowest point in 2018 so far. People felt less confident about their current financial position, how they expect their financial position to change, their job security and the amount they expect to spend on expensive items over the next year.

The local political impasse was the factor that the highest number of people highlighted as impacting them most negatively. Unfortunately, it does not appear that devolved government will return any time soon. The business community has been vocal in its frustrations around the political situation, but our survey has consistently shown that consumers are equally as frustrated and concerned about the impact that the lack of a functioning Executive is having in Northern Ireland.

Consumers also pointed to high inflation as having a negative impact on how confident they were feeling. After increasing during the summer months, inflation fell to 2.4 per cent in September. While a fall in the rate of price rises is welcome news for consumers, who have endured a squeeze on their purchasing power for some time now, it’s important to remember that inflation is still above the Bank of England’s 2 per cent target. As such, there is still some pressure being applied to household budgets.

The other driver behind the fall in consumer confidence was Brexit. As might be expected, some people viewed Brexit as a positive and some people viewed it as a negative. In this survey, there was a larger number of people who viewed Brexit negatively. Thirteen per cent of people said the pace of progress during the Brexit negotiations in recent months was the factor that had the largest negative impact on their confidence levels. A further 11 per cent stated that the UK Government’s longer-term Brexit objectives was the factor that had the biggest adverse impact on them. These numbers were up from 10 per cent and 9 per cent in the third quarter of last year.

We also give survey respondents the opportunity to highlight these same Brexit factors as having a positive impact on them. In the third quarter of 2017, 12 per cent of people said the Government’s longer-term term Brexit objectives had the biggest positive impact on how they were feeling and seven per cent said the progress in the talks process in recent months had positively affected them. In the third quarter of this year, those numbers were 6 per cent and 8 per cent respectively.

On balance, it appears as if people’s attitudes have shifted over the last year towards a more negative impression of Brexit. This follows months of relatively limited progress in the Brexit negotiations, with the backstop still proving the main sticking point. There is also still considerable uncertainty about how the UK and the EU will interact in the future.

It is important to point out that, despite the fall in confidence, our survey did reveal some good news. One in five people we surveyed said rising wages was having a positive impact on how they were feeling.

The Northern Ireland labour market has proven quite resilient in the face of the high uncertainty of the last couple of years. The number of employee jobs in the economy has increased every quarter since the start of 2016. As economic theory would predict, this strong jobs growth has put upward pressure on wage growth. Alongside the evidence from our survey, data published last month showed that over the year to April 2018, median weekly earnings for full-time workers increased by 4.2 per cent. This was the fastest rate of earnings growth since 2015.

The fact that people’s pay packets seem to be growing at a faster rate is clearly something we can take encouragement from.

On balance, the latest Consumer Confidence Index painted a negative picture. As such, we expect consumer spending growth in Northern Ireland to be fairly modest this year and next year. If the pace of economic growth in Northern Ireland is to pick up, one of the things we will need to see is an upturn in how confident people are feeling, and in the amount they are spending.

:: Conor Lambe is chief economist at Danske Bank