“Anatomy is destiny” (Sigmund Freud)

:: Short and sharp (so far)

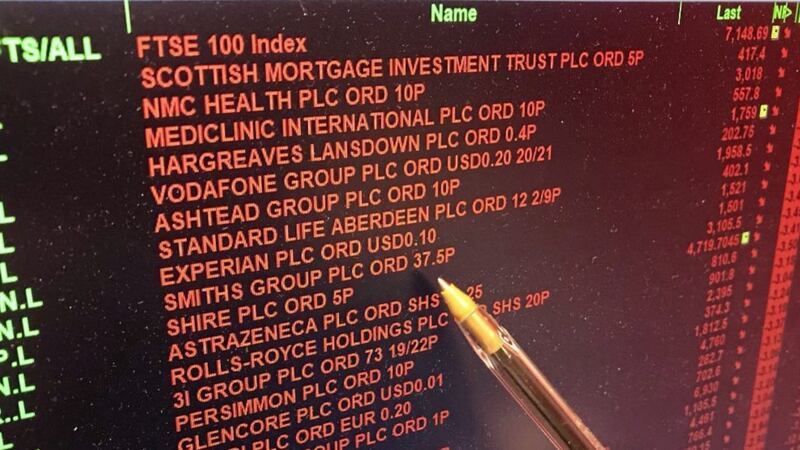

NO matter how much we talk about expecting more volatility, the experience of it is always jarring. Plunging stock markets invariably exhume the doom mongers from their ever shallow graves - the beginning of the end is finally upon us we’re told. Meanwhile, TV screens flash with disquieting headlines about hitherto barely considered black swan candidates.

At the centre of this rout were some vehicles designed to benefit from the low levels of equity market volatility seen over the last year. Essentially, these products were providing market insurance to those in need. As with all types of insurance, the returns structure to those willing to provide it tends to be negatively skewed. Premiums role in month after month until the event you are receiving premiums for occurs and a sharp loss ensues. Given the prolonged period of subdued market volatility, it may be that some of these unwitting ‘insurers’ had forgotten exactly what they were receiving payment for. The related exchange traded notes (ETNs) have been closed and heavy (and permanent) losses have been inflicted on the unfortunate owners.

In amongst all the noise, the important point for the health of the wider market is that the short volatility trade is neither large enough nor interconnected enough to be the cycle killer this time around.

:: Inflation...

Inflation remains the more likely eventual party pooper. To that end, this so far contained bout of market hysteria seen over the last week seemed to be catalysed by last Friday’s higher than expected US wage growth number. If such an isolated harbinger of more pronounced inflationary pressures can have that effect on markets; what will happen when the actual inflation data starts to rise, as it should in coming months?

Any accumulating complacency from what was a historically remarkable period of market calm (unseen since pre-1929 on some measures), has surely been dispersed. Meanwhile, the bond market looks less surreally disconnected from the incoming economic reality than it did say six or even three months ago. The speed of that adjustment has seemingly induced some temporary vertigo elsewhere in capital markets. However, all in all, they now look a little better placed to digest the steady pick-up in inflationary pressures that we expect in the months and quarters ahead.

One of the interesting aspects of this recent pull-back was the relative performance of regions and sectors. Most of the time, if the traditionally less volatile US stock market falls, you will find that the riskier areas of the global stock market fall by more – emerging markets in particular, but also Continental European equities. This was not the case this time around. In fact, there was scant evidence of a flight to safety or indeed quality even within the US stock market. This was a more or less ubiquitous sell-off in terms of regions, sectors and factors. We can only guess at what such market anatomy tells us about what is to come. However, over the last few months, we have been reorienting our portfolios, in particular our equity exposure, towards the regions and sectors where cyclical prospects and valuations are now best aligned in our opinion. This leaves us focusing on Continental European equities in the developed world over US and Asia within emerging equities. Industrial, financial and technology companies still look the best way to play a world economy where the recovery in capital expenditure is broadening geographically, and strengthening.

History tells us that in the absence of a looming recession, of which no data is giving us any hint yet, investors can expect decent 12 month returns after such a pull-back. Meanwhile, corporate free cash flow margins and yields tell us both that companies are still in good shape and that their stocks are not as fiercely overvalued as some have argued.

:: Investment conclusion

The unnaturally strong start to the year for risk assets, fuelled by the arrival of the herd, has come to a juddering halt. There is no cause for alarm however. A fat-tailed slap for those shorting volatility is a healthy reminder to the rest of us that there is little room for complacency when it comes to investments. However, while the economic sky remains so blue, we are still best off invested in stocks, even if central bankers and bond markets are rightly set to make the ride a little rougher this year.

:: Jonathan Sloan (jonathan.sloan@barclays.com) is a private banker at Barclays Wealth & Investment Management