MANUFACTURING is key component of Northern Ireland’s economy, representing around 14 per cent of local GVA. It is our second largest sector in terms of value and the third biggest sector in terms of employment. Indeed manufacturing outperforms every other sector in exports: at the UK level it accounts for 45 per cent of all exports, 57.5 per cent of which are to the EU and therefore the question of trade is of utmost importance to it and the many employees working in this sector.

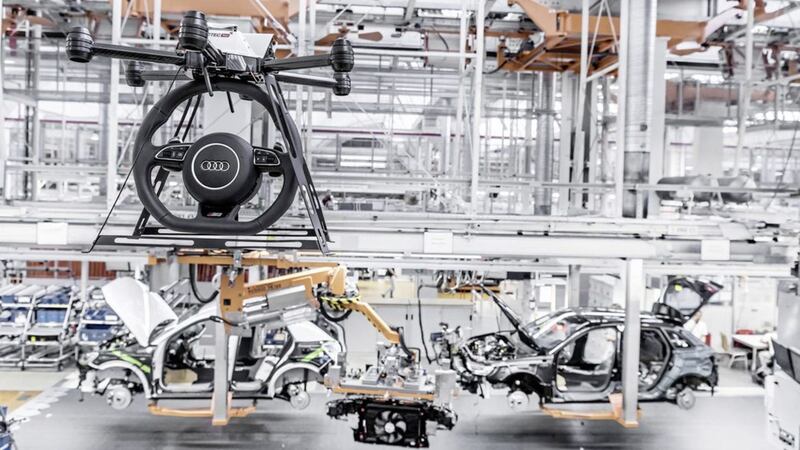

Today’s manufacturers are part of complex integrated supply chains that extend across the EU, for example 60 per cent of parts supplied for cars built in the UK are imported, mainly from Europe.

The potential imposition of tariffs between the EU and the UK has the potential to hugely increase costs for manufacturers. For example, food manufacturers could face an average EU tariff of 22.3 per cent against 2.3 per cent for non-food products. However, non-tariff barriers that interrupt just-in-time delivery models and increase compliance costs could be just as disruptive – if not more so, for many manufacturing sub-sectors.

:: Regulation: When it comes to regulation, the manufacturing sector wants regulations that will allow continued easy access to our largest market (the EU). Manufacturing exports are currently subject to many regulations and standards that keep products harmonized across the EU, the current regulations work to simplify trade and create a level playing field in terms of competition. The majority of manufacturing firms believe the UK should continue to meet these mutually recognised product standards, and continue to be involved in their design, in order to support ease of movement of goods across the region and across the globe. Manufacturing businesses are today raising questions about cross-sectoral EU regulations in areas including energy, the environment and financial regulation.

:: Migration: Today, international labour, skills and flexibility of employee movement works to support growth in the manufacturing sector. With hard-to-fill vacancies from engineering to IT roles, nearly two-thirds of manufacturing firms surveyed by the CBI see challenges in recruiting the skills they need in the years ahead. Some of the skills gaps in manufacturing have in recent years been filled by EU citizens and this has allowed companies to successfully take on new orders and expand. However, with the future now uncertain for these employees, it is crucial that government has a balanced approach to immigration – one that addresses labour shortages and supports investment. In the long-term, the skills issue for manufacturing will need to be addressed in the education system through the continued encouragement of STEM in schools and the provision of high-quality careers advice which portrays manufacturing as an attractive career. However, the labour implications of Brexit go beyond this: today’s manufacturers move highly skilled engineers between the UK and EU Member States at short notice and Brexit risks a loss of this flexibility. If a company’s engineers cannot move quickly between the UK and the EU, local competitiveness and capacity will be negatively impacted.

:: Funding: It is primarily through innovation and R&D that EU funding will affect the manufacturing sector. Manufacturing alone accounted for 68 per cent of UK R&D expenditure in 2015 and therefore is highly exposed to changes to the funding scheme landscape. While the government has committed to underwrite Horizon 2020 funding after the UK leaves the EU, there must be programmes and schemes established to replace the EU funding mechanisms in the long-term. It is also vital for manufacturers to be able to maintain collaborative research links to ensure that they avoid being left behind. The CBI argues that a new funding deal is needed for innovation which must support R&D and collaboration in the manufacturing sector.

:: International Trade Agreements: While there may be new opportunities stemming from an ambitious international trade agenda that benefits the manufacturing sector, the EU deal is the priority. Business needs to be closely involved in the process of any new trade deals – as some domestic producers, particularly in the agri-food sector, have already raised concerns about challenges from countries that do not operate on a level playing field. Additionally, many manufacturing businesses benefit from current preferential trading agreements that are already in place, including with South Korea and South Africa, and are seeking clarity about the future of those deals.

:: No deal is not an option: The process of leaving the EU must be as smooth as possible for the manufacturing sector. In a scenario where the UK leaves the EU without a deal or temporary interim arrangement, the sudden imposition of tariffs and complex customs processes would be hugely disruptive for firms and the wider economy. Confusion and delays for imports and exports have the potential to affect entire supply chains if sufficient time is not secured to transition to new arrangements. A period to adapt to any new deal is critical, ‘no deal’ is simply not an option.

:: Angela McGowan is director of CBI Northern Ireland. Follow her at @angela_mcgowan