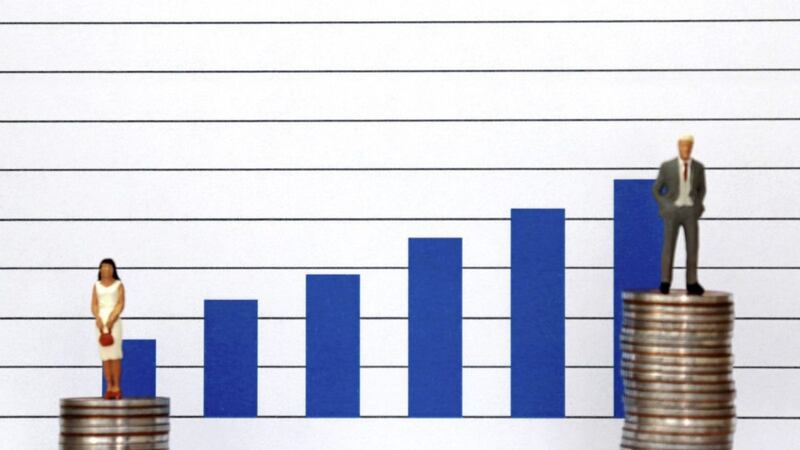

Northern Ireland has the largest gender pension gap in the UK, a provider said.

Average retirement savings totalled more than £20,000 for men and just under £10,000 for women.

Lower pay and taking time off work to look after children were among the reasons, online pension firm PensionBee said.

Romi Savova, CEO at PensionBee, said: "I would urge women in Northern Ireland to consider how they can save more into their pensions to take advantage of the tax benefits available.

"Too many savers are still unaware that they can claim tax top-ups on their personal pension contributions and are effectively missing out on free money from the government.

"Basic rate taxpayers can get a 25 per cent tax top-up while higher and additional rate taxpayers can claim a further 20 per cent and 25 per cent respectively."

She said the onus should not be on women alone to make up the shortfall and that it is time for the government to introduce dedicated initiatives to bridge the gap, starting with tackling the gender pay gap.

"We know that where men get paid more than women, it is highly likely that they will have larger pensions."

PensionBee analysed the data of more than 13,500 of its customers and found that savers in Northern Ireland had the largest gender pension gap of 54 per cent, with average retirement savings for men totalling £20,091 and just £9,183 for women in the region.