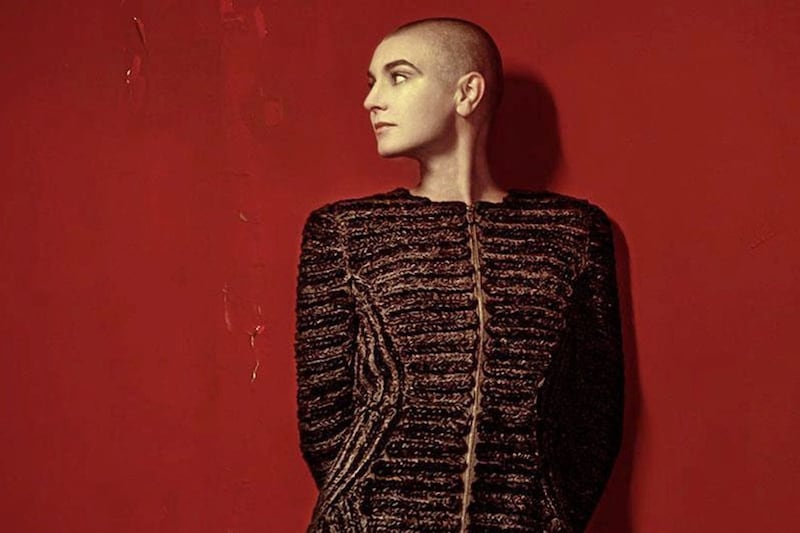

SINGER Sinead O'Connor has made a settlement with tax inspectors in the Republic.

The award-winning artist, who has a home in Bray, Co Wicklow, was named as having paid out 160,304 euro (£138,226) for the under-declaration of PAYE and PRSI following an audit.

The Revenue Commissioners calculated tax of 90,543 euro (£78,071), interest of 42,599 euro (£36,732) and penalties of 27,162 euro (£23,423) to be paid by the top-selling musician.

O'Connor's name was one of dozens which appeared in the Defaulters' List, published every three months by the Irish Government with details of major tax settlements.

From April to June this year 101 people and businesses had their cases finalised with the tax inspectors taking in a total of 17.44 million euro (£15.03 million).

Among the largest published involved James Farrell, who was listed as a retired company director from Oldcastle Road, Kells, Co Meath.

He settled with the tax inspectors for 1.4 million euro (£1.2 million) for the non-declaration of capital gains tax and VAT.

HM Yachts, a boat sales agent based out of Fennell's Bay, Myrtleville, Co Cork, is now in liquidation but had to make a settlement worth 923,782 euro (£796,425) for the under-declaration of VAT.

A plane painting and glazing company, IAC Graphics, based at Dublin Airport, had a bill for 1.1 million (£948,000) euro for the under-declaration of VAT, PAYE/PRSI and corporation tax.

Office equipment suppliers Bizquip, based in the Sandyford industrial estate in Dublin, had a 925,463 euro (£797,874) settlement for under-declaration of PAYE/PRSI following a Revenue offshore assets investigation case.

Kevin Cronin, a plastic surgeon, and listed as a medical consultant with an address on Eccles Street in north Dublin, settled a case for 534,252 euro (£460,586) for the under-declaration of income tax.