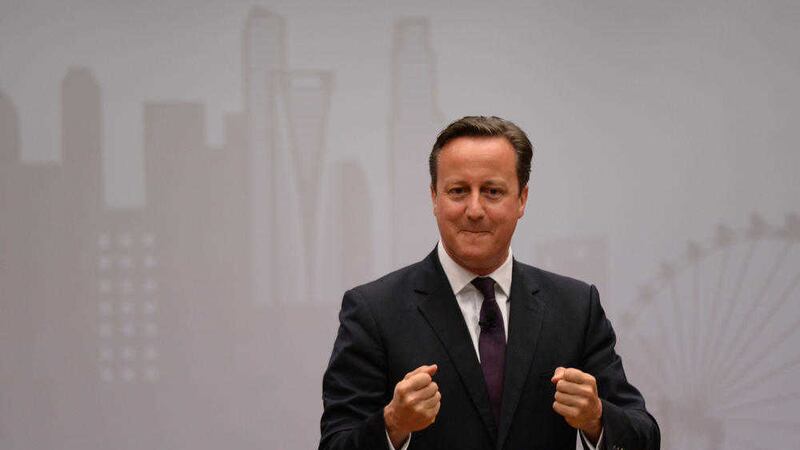

DAVID Cameron has been forced to defend his family's tax affairs, as the Panama Papers data leak claimed its first political casualty.

Facing calls to explain his family's finances, the prime minister declared he has "no shares, no offshore trusts, no offshore funds".

But Mr Cameron declined to say if his family had reaped the rewards of an offshore arrangement in the past or were likely to in the future.

He came under scrutiny after his late father Ian's tax affairs were highlighted in the document disclosure.

Mr Cameron said: "In terms of my own financial affairs, I own no shares. I have a salary as prime minister and I have some savings, which I get some interest from, and I have a house, which we used to live in, which we now let out while we are living in Downing Street, and that's all I have.

"I own no shares, no offshore trusts, no offshore funds, nothing like that. And so that, I think, is a very clear description."

Number 10 went further, stating: "To be clear, the prime minister, his wife and their children do not benefit from any offshore funds.

"The prime minister owns no shares.

"As has been previously reported, Mrs Cameron owns a small number of shares connected to her father's land, which she declares on her tax return."

Labour leader Jeremy Corbyn has called for an investigation conducted by HM Revenue and Customs "about the amount of money of all people that have invested in these shell companies or put money into tax havens and to calculate what tax they should have paid over the years".

Mr Corbyn also suggested the government could intervene to take direct control of the UK's offshore tax havens.

"If it's necessary for ministers to intervene because the governments of the Overseas Territories won't act, they can use an order in council to take control of them immediately," he said.

The prime minister has championed the transparency agenda at a series of international summits, and legislation forcing British companies to disclose who owns and benefits from their activities comes into force in June.

But despite several years of pressure, the Crown Dependencies and Overseas Territories have proved reluctant to fully open up their business registers to UK law enforcement agencies.

Mr Cameron hopes for more action ahead of a major international anti-corruption summit he is hosting in May.

His father ran an offshore fund that avoided ever having to pay tax in Britain by hiring a small army of Bahamas residents – including a part-time bishop – to sign its paperwork, according to the Guardian.

Ian Cameron, who died in 2010, was a director of Blairmore Holdings Inc, which, until 2006, used unregistered "bearer shares" to protect its clients' privacy.

His use of the firm to help shield investments from UK tax helped build up a significant legacy, part of which was inherited by the prime minister.

There is no suggestion that this avoidance arrangement or others exposed by the leak were anything but entirely legal or that Mr Cameron's family did not pay the UK tax due on any repatriated assets.

Labour MP Wes Streeting (Ilford North) described Mr Cameron's statement as "partial" and claimed that "it raised more questions than perhaps it answered".

Mr Streeting, a member of the Commons Treasury Committee, told BBC Radio 4's Today programme: "I think the clarification about whether or not he or his family will benefit in the future is a welcome clarification.

"I think there are still questions about whether or not he's benefited in the past and I think we could do with having far more tax experts coming out and saying that actually he has squared off all possibilities.

"I think where David Cameron made a rod for his own back was issuing what was quite a qualified statement, that then led people to think, 'is he being shady about this, is he being evasive, are there further questions to ask?'"

Mr Streeting said the issue about tax havens was about openness and transparency.

He said: "It's really clear that the UK, acting independently but also in conjunction with other countries, still has far more to do to tackle aggressive tax avoidance and tax havens.

"And so from a public point of view the question will be, when our prime minister says he's serious about tackling it, he's said it many times, are we absolutely certain he doesn't have a vested interest, and even if he does have a vested interest would he be upfront with us about it."

Mr Streeting acknowledged the prime minister has "showed leadership" on this issue domestically and internationally, but much more needed to be done.