WITH the Chancellor having to do two major about turns recently, thwarting his attempts to balance the books, the budget contained a few surprises.

He expects that during the year the UK deficit will be down by almost two thirds from its peak and expects the deficit to be eliminated entirely over the next four years, producing a surplus by 2019-20. To aid this he has tasked government departments to produce a further £3.5 billion of savings.

Recently a lot of activity has focused on tackling tax evasion by major multinational corporations but the Chancellor wants to attract major multinational corporations to the UK and so is reducing the rate of corporation tax by 2020 from 18 to 17 per cent.

He also made it clear that he expects these corporations to pay their fair share of UK tax and announced that the Government will produce a road map to make the UK a low tax attractive location for international investment. For us locally he affirmed his aim to continue working to introduce the corporation tax rate here to 12.5 per cent by April 2018.

The UK has traditionally been seen as a favourite location for multinational corporations because it allows full tax deductions for interest payments. Interest is to be capped from April 2017 for some large companies at 30 per cent of their UK earnings along with other restrictions and measures to ensure that large companies pay their fair share of UK tax.

Welcome surprises came in the form of cuts in the rate of capital gains tax (CGT) and an increase in individual personal allowances from £10,600 this year to £11,000 in April 2016 and a further increase to £11,500 in April 2017.

The point at which the higher rate of tax will commence will increase from £42,385 now to £43,000 in 2016 and £45,000 in 2017. This is a welcome reverse from the previous trend which saw personal allowances increasing but higher rate tax starting points decreasing.

From April 2016 CGT will be cut from 28 to 20 per cent for higher rate taxpayers and from 18 to 10 per cent for basic rate taxpayers. These changes will not however apply to the disposal of residential properties. The Chancellor’s strategy is to deter people from owning multiple properties which he believes deprives others from accessing the housing ladder.

The much hyped sugar levy is being introduced from April 2018 on drinks with a specified sugar content. The funds raised will be applied to school spending on sports.

Another surprise was the freezing of fuel duty in light of the falling oil prices. The duty has been frozen for the sixth year saving the typical motorist £75 a year. Additionally no increases in duty on beer, cider, or spirits were announced but wine drinkers will have to dig deeper where the rise is in line with inflation.

Stamp duty on commercial premises has been increased with a nil rate band of £150,000 after which the rate of duty will then be 2 per cent up to £250,000 and 5 per cent above £250,000.

It is a welcome relief to higher rate taxpayers that proposed pension changes have not been made and the Chancellor has introduced a lifetime ISA where adults under 40 can save up to £4,000 each year and receive a 25 per cent bonus from the Government. This money can be saved until age 60 after which it can be used for retirement income. It can also be withdrawn to buy a first home.

A budget with some surprises but also more book balancing!

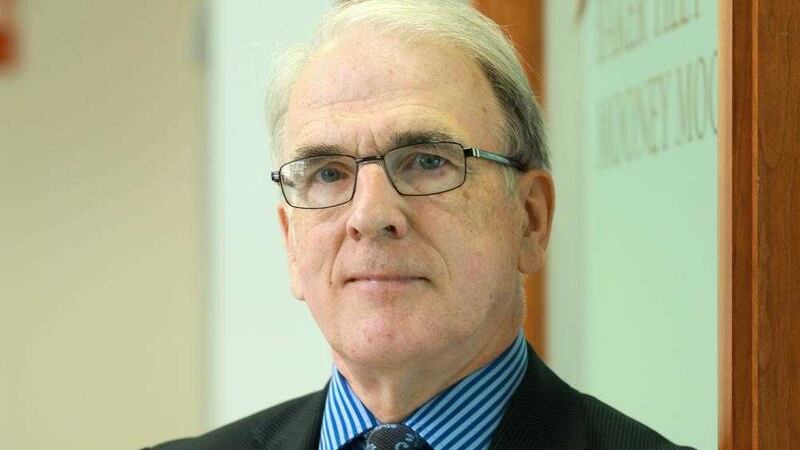

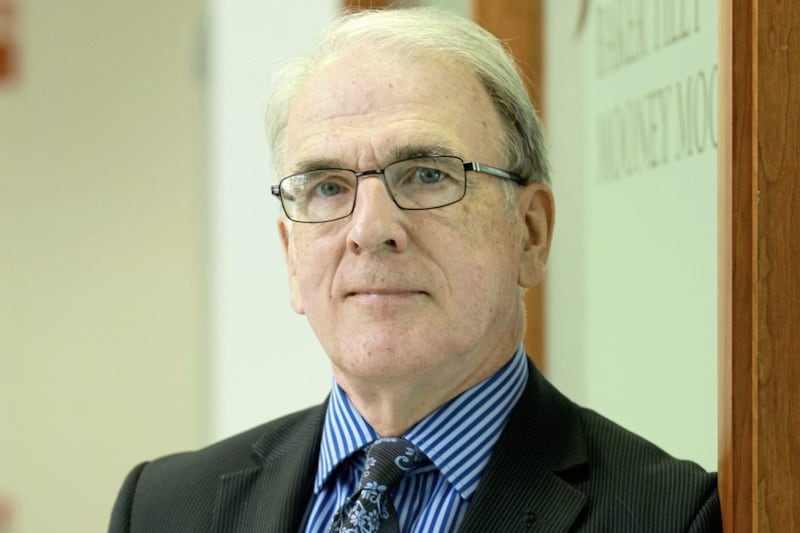

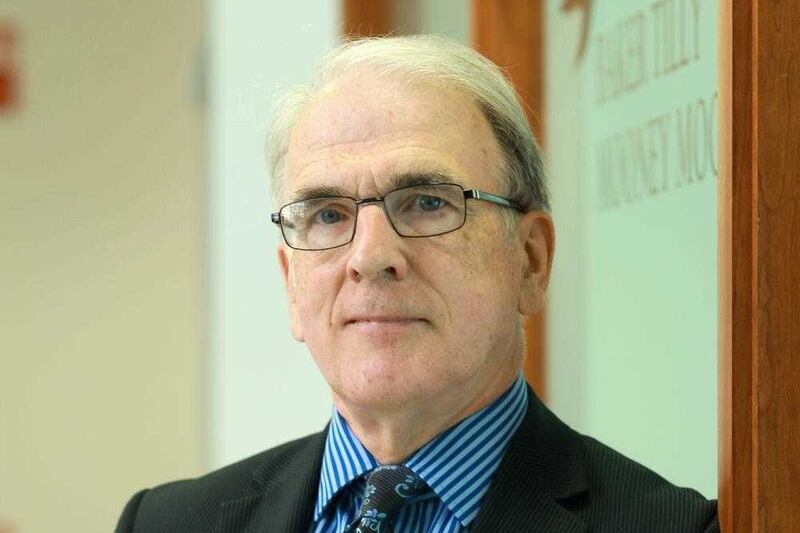

:: Tom Penman is tax partner in Baker Tilly Mooney Moore (www.bakertillymooneymoore.co.uk), specialising in complex tax planning, structuring groups of companies, international tax, providing tax efficient succession and inheritance tax planning and dealing with all aspects of income tax and capital gains tax.