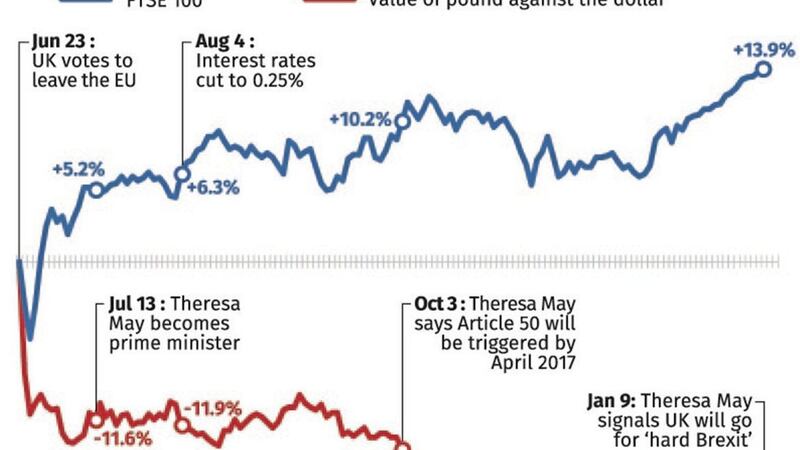

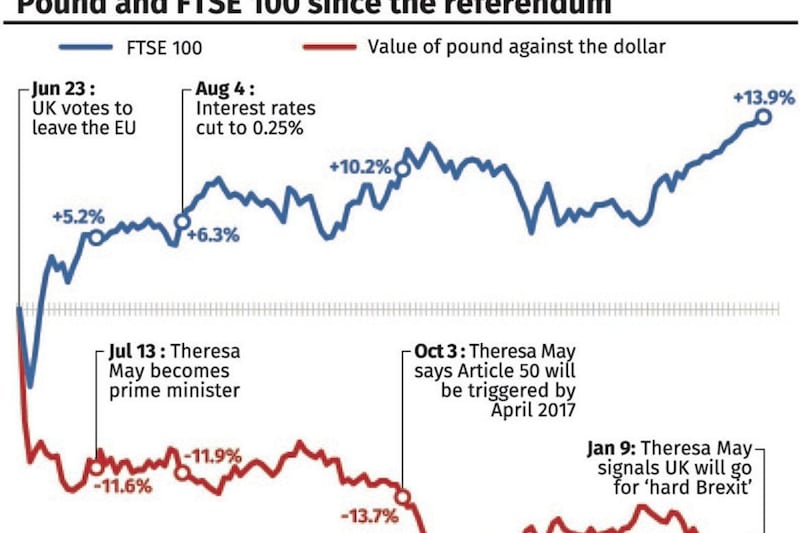

LONDON'S top-flight index closed at a record high for the eighth consecutive session, boosted by sterling's collapse following hints from the Prime Minister that Britain my opt for a "hard Brexit".

The FTSE Index rose 27.72 points to an all-time closing high of 7,237.77, as the market continued to benefit from the pound's slump.

It marks the longest record closing streak since the beginning of May 1997, putting the London market on course for its longest ever record closing streak if it reaches an all-time closing high on today.

The further push into record territory came during a remarkable rally yesterday, with the top-flight delivering a new mid-session record of 7,243.76 after investors snapped up stocks on the back of the pound's plunge to a two-month low against the US dollar.

Sterling was under severe pressure on the currency markets following an interview with Theresa May on Sunday, in which she stated the importance of taking control of immigration over access to the European single market.

The pound hit lows not seen since last October, dropping 0.9 per cent versus the greenback at 1.21 and falling 1.3 per cent against the euro at 1.151.

Sterling's lows remained entrenched despite Mrs May moving to clarify her comments, telling a London press conference: ''I'm tempted to say that the people who are getting it wrong are those who print things saying I am talking about a hard Brexit (and that) it's absolutely inevitable there's a hard Brexit.

''I don't accept the terms hard and soft Brexit."

The UK currency's fall since the Brexit vote has proved beneficial for multinational companies listed on the index, as many tend to benefit from earnings in currencies – such as the US dollar – which are performing more strongly than sterling.

Across Europe, Germany's Dax was down 0.5 per cent and the Cac 40 in France slipped 0.3 per cent.

On the oil markets, the price of Brent crude slipped amid concerns over growing US production and the Opec cartel's ability to drive through cuts to support prices.

The price of oil was down 3 per cent – or US$1.71 – to US$55.39 a barrel

In UK stocks, London-listed miner Glencore was sitting at the top of the biggest risers after a positive note from Barclays on the outlook for the mining industry.

Shares were up more than 3 per cent, or 10.3p to 298.7p, after the bank said that an ongoing infrastructure spending splurge from China, coupled with potential fiscal stimulus from western countries, made the sector's valuation look reasonable.

Lloyds Banking Group was among the biggest fallers, dropping 0.7p to 65.2p, after the government reduced its stake in the lender to less than 6 per cent, meaning the taxpayer is no longer the group's largest shareholder

Away from the top tier, betting giant William Hill was nursing hefty losses after warning that profits would suffer a £20 million hit following a string of "customer-friendly" results in December.

The high street bookmaker said full-year operating profit for 2016 would come in at around £260m, the bottom end of its £260m-£280m range.

Shares were down more than 2 per cent, or 6.1p to 291.6p, on the FTSE 250 index.

The biggest risers on the FTSE 100 Index were Glencore up 10.3p to 298.7p, Randgold Resources up 145p to 6,660p, British American Tobacco up 101p to 4,675p, Imperial Brands up 78p to 3,616.5p.

The biggest fallers on the FTSE 100 Index were Capita down 15p to 500.5p, Land Securities down 23p to 1,034p, Royal Bank of Scotland down 5p to 227.4p, Whitbread down 76p to 3,865p.