OUR ISAs, pensions and investments can take a bit of a hiding when there is market turmoil, but understanding that, and how it may benefit, creates the opportunity. It also creates an opportunity for investors to lose significant returns on their investments with knee jerk reactions of exiting.

A few months ago, I showed a range of highly positive media headlines regarding markets (which would have sucked in investors) that were followed by significant losses, and a range of negative headlines that were immediately followed by significant gains. There is significant noise, and seeing through noisy data unemotionally with investments is paramount.

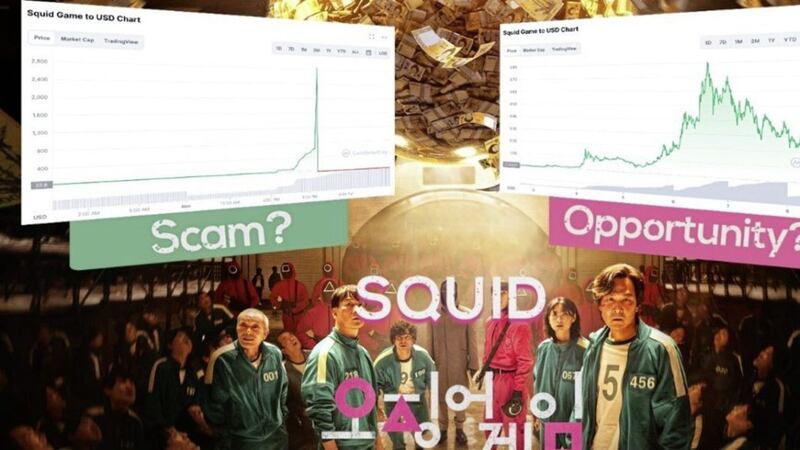

You might also remember that ‘pump and dump’ schemes which dine out on headlines also exist. ‘Pump and dump’ is where any organisation deliberately moves a market either up or down, to then sell it, or buy it at over its value (sell), or under its value (buy).

In 2019, Morgan Stanley was fined €20 million for pump and dump tactics, and, of late, there have been many pump and dump strategies in the virtually unregulated crypto currency sector.

These scams have taken in more than $2.8billion of crypto in 2021. The person looking to sell the asset uses multiple social media platforms and ‘nice girl avatars’ to ‘pump’ up the prices, relying on your ‘Fear of Missing Out’ (FOMO) and hey presto, as the price is rising, they are quietly exiting the market at a hefty gain. Squid Coin is believed to have made the creators the easiest $3 million they could have imagined.

Emotions can run high with FOMO and the reaction inside the brain is well known to those keen to make your loss is their gain. For every winner there’s a loser and vice versa.

When in any state of high arousal (fear or excitement), the brain’s ability to think logically greatly diminishes, and the mind becomes very binary: vote blue or red; brexit or remain; mask or anti mask – you get the drift. This strategy is also very well-known and strategized to those that wish to part you with your hard earned cash, and of most note is that when we are aroused, we are highly suggestible.

People are often anxious: worried about paying a bill, feeding their family, unhappy with their relationships, overworked. It is hard to have your emotional needs met when so many of the cogs are rusty or not working. When our emotional needs are not met in the correct way, psychologically we might try to have them met in other ways, some of which may be unhealthy.

‘If only I won the Euromillions, I would be grand’.

And that is where the emotion kicks in. Over arousal makes your investment into a product (Euromillions) with a 139,838,160 chance of winning a sensible one. In reality, on the Monday, you won’t be knocking the overtime on the head and its back to the grindstone £2 lighter.

Currently the Securities and Exchange Commission has sent subpoenas to a range of high-profile company names in the US regarding block trading abuses and we will wait to see the outcome from that.

In September 2021, Jay Powell ordered a review of the Federal reserve’s ethics rules after concern about trading at the Fed. Certain officials under fire for securities trading resigned.

In January 2022 the Federal reserve’s vice chair resigned (the third in as many months) following revelations regarding his stock trading at the beginning of the coronavirus pandemic. Markets had plummeted with coronavirus mayhem, but the vice chair moved capital into stocks, just before the Fed announced it was prepared to step in and provide economic support.

As a psychologist friend once said to me: ‘stop trying to push your views of fairness on to the world. Accept it is not fair and navigate through it”.

That is indeed true, so do the right thing with any money decisions and just run it by a cool head such as your independent financial adviser, solicitor or accountant.

Breathe, breathe some more and take your time. That investment will prove one of the best you will ever have made.

Peter McGahan is chief executive of independent financial adviser Worldwide Financial Planning, which is authorised and regulated by the Financial Conduct Authority. If you have a financial query call Darren McKeever on 028 6863 2692, email info@wwfp.net or visit wwfp.net