ONE interesting debate doing the rounds at the moment is whether the pandemic could actually help galvanise the world on climate.

There is substantial overlap in the countries and segments of society that have absorbed the worst blows from the pandemic and will suffer the most from climate change – many of the world’s poorest countries are already clustered in the hottest zones on the planet.

Today, a smaller percentage of their population has been vaccinated and in the decades ahead, if current temperature changes continue unchecked, it is these areas that will suffer the most serious blows to their economic and wider wellbeing.

Battling climate change effectively requires us to mobilise efforts long before the economic costs will become apparent. The fact that no country was prepared for the pandemic (some worse than others) in spite of multiple devastating outbreaks in the preceding years and persistent warnings from the scientific community and beyond, is surely a source for concern here.

Many policy-makers were only spurred into meaningful action after the economic costs began to rapidly accrue. Furthermore, like the pandemic, the battle to avert a devastating further rise in global temperatures requires global cooperation.

The world’s scientists found a way to collaborate on vaccines with break-taking results. Giving space and resource for science is clearly part of the answer on climate too. The development of scale carbon capture or negative emission technologies is a good example as are the incoming advances in battery storage. The precipitous drops in solar panel technology over the last decade point the way.

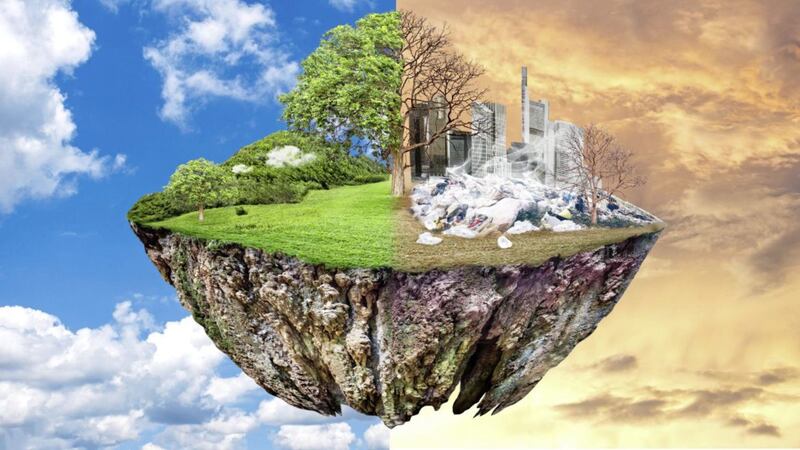

However, as with the Corona-crisis, the march of technological advance, however accelerated, is a necessary but not sufficient input. Behaviours, societal norms, and spending priorities need to be changed dramatically if the predicted temperature rises and accompanying economic catastrophe are to be averted.

For the investor, there is a part to play here. ESG (environmental, social, governance) funds, also known as sustainable or responsible investments, were once seen as the preserve of the chattering classes. However, over the last number of years, much has changed, as investors started to seek out opportunities to back companies with values and aims reflecting a more responsible world view.

Of course, this isn’t simply a moral viewpoint taken without commercial sense, as the rationale is that those companies dedicated to environmental or social goals and those demonstrating good corporate governance are also those most likely to succeed financially and stay the course.

The next few years are likely to see an increase in the number of investment options geared towards investors who are putting this criteria as a core issue for their investment selections.

For the investment community, this may pose some interesting challenges as it wrestles to place ESG investments in the correct risk profile and asset class comparison tools. These are primarily built along the traditional trade-off between risk and return and time will tell whether the values of ESG alone will be enough to keep them top of mind if profitability doesn’t follow.

If this last short period in human history has taught us nothing else, it has strongly reminded us that there are very few problems which can’t be overcome by the continued ingenuity and reinvention of that collective human effort.

That is something worth celebrating and now is the time to remind ourselves that we are all in this world together, and the planet we call home is the collective responsibility of us all.

Jonathan Sloan is head of Barclays Wealth & Investment Management in Belfast