IT'S safe to say that 2020 will live on in many people’s memories as a year like no other and as we enter the last month of the year it is with a sense of relief. The pandemic has dominated on a global basis and turned working practices upside down, what is normal going forward is likely to be very different.

This is only one aspect of the impact: we have no clear idea yet of the magnitude of the economic effect and this will only become apparent with time. As we see signs of the second wave waning, who is to say that there will not be a third or even a fourth?

Hope is now real as we await details of the vaccine roll-out, but this in itself is a logistical challenge and it is likely to be months before herd immunity is achieved.

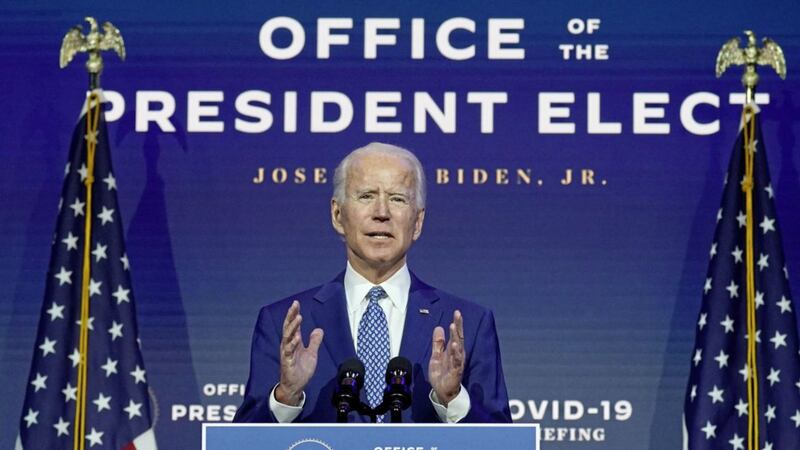

We have also faced a US Presidential election which has been extraordinary. The refusal of President Trump to concede has revealed a bitterly divided society which presents a huge challenge for the President-elect.

The impact of Joe Biden’s policies is also far from clear: he is known to be much more aware of climate change issues, but will there be adverse implications for the highly successful large technology companies and how much power will he really have with the Senate in Republican control?

In the UK we are facing the end of the Brexit transition period at the end of the month and so far there is no trade deal, a circumstance which is causing alarm in many areas. In the financial services industry, for example, which employs about 2.3 million people and makes up about 7 per cent of the UK’s output, it is estimated that we have seen about 7,500 jobs move from the City of London to the EU and there could be more to come. In manufacturing there are huge uncertainties: the EU is a vital market, for example it accounts for more than half of the exports in the automotive industry.

The logistics of no deal are also daunting: when French border officials tested a new system, it led to five-mile queues for hauliers.

Here in Northern Ireland we still face questions as to how the border between Britain and Northern Ireland will work, with huge implications for supermarkets, manufacturers and wholesalers. As businesses scramble to stockpile goods, it is clear we are going right up to the wire on this one and the future is far from clear.

No quiet end to the year in terms of the stock market: uncertainty is the one thing that unsettles the market most and we have it in abundance. However, on a slightly more optimistic note, the market always looks ahead, anticipating the future direction, and there is no doubt that even with some industries struggling (who would have anticipated the demise of Philip Green’s Arcadia?) there is value to be found.

The UK market still lags significantly behind other markets in terms of performance since the beginning of the year, but there is an increase in merger and acquisition activity and as talk increases of a rotation from growth to value, there could be grounds for cautious optimism.

:: Cathy Dixon is a partner at the Belfast office of Smith & Williamson Investment Management. This article does not constitute a recommendation to buy or sell investments and the value of any shares may fall as well as rise.